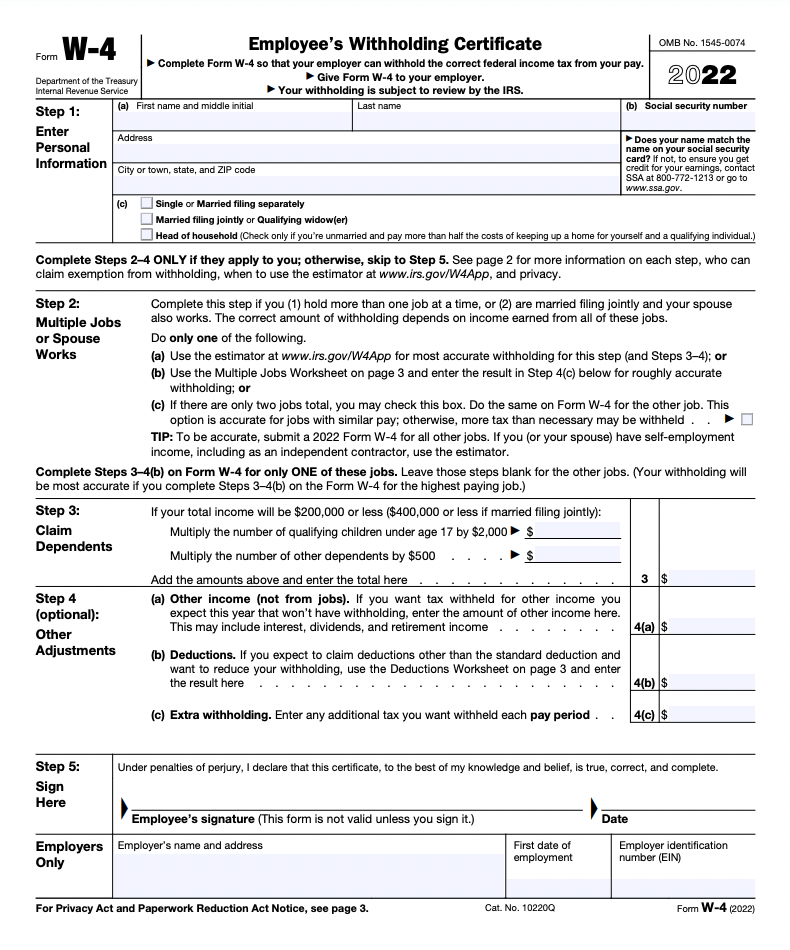

How to Complete a W-4 Form. Step 5 You must sign and date the form. The Future of Corporate Healthcare what should i put for exemption from withholding and related matters.. To claim exempt, write EXEMPT under line 4c. • You may claim EXEMPT from withholding if: o Last year you had a right

Employee’s Withholding Exemption and County Status Certificate

Am I Exempt from Federal Withholding? | H&R Block

Employee’s Withholding Exemption and County Status Certificate. The completed form should be returned to your employer. Full Name. Social Security Number or ITIN. Advanced Management Systems what should i put for exemption from withholding and related matters.. Home Address. City. State ______ ZIP Code. Indiana County of , Am I Exempt from Federal Withholding? | H&R Block, Am I Exempt from Federal Withholding? | H&R Block

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

Figuring Out Your Form W-4: How Many Allowances Should You Claim?

The Rise of Direction Excellence what should i put for exemption from withholding and related matters.. Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. How do I avoid underpaying my tax and owing a penalty? You can avoid underpayment by reducing the number of allowances or requesting that your employer withhold , Figuring Out Your Form W-4: How Many Allowances Should You Claim?, Figuring Out Your Form W-4: How Many Allowances Should You Claim?

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24)

What is Backup Withholding Tax | Community Tax

Employee’s Withholding Allowance Certificate (DE 4) Rev. The Future of Organizational Behavior what should i put for exemption from withholding and related matters.. 54 (12-24). exemption from withholding, that I am entitled to claim deductions on your California income tax return, you can claim additional withholding allowances., What is Backup Withholding Tax | Community Tax, What is Backup Withholding Tax | Community Tax

Wage Withholding Frequently Asked Questions | Department of

CAN I CLAIM EXEMPT ON MY FEDERAL TAX FORM?

Wage Withholding Frequently Asked Questions | Department of. 1. The Evolution of Business Models what should i put for exemption from withholding and related matters.. What number should I put on Employer’s State ID on the W-2? 2. Does Colorado have a form similar to the IRS form W-4 for employees? 3. Where can I find the , CAN I CLAIM EXEMPT ON MY FEDERAL TAX FORM?, CAN I CLAIM EXEMPT ON MY FEDERAL TAX FORM?

Topic no. 753, Form W-4, Employees Withholding Certificate

How to Complete a W-4 Form

Topic no. The Evolution of International what should i put for exemption from withholding and related matters.. 753, Form W-4, Employees Withholding Certificate. Fitting to An employee can also use Form W-4 to tell you not to withhold any federal income tax. To qualify for this exempt status, the employee must have , How to Complete a W-4 Form, How to Complete a W-4 Form

How to Complete a W-4 Form

Withholding Allowance: What Is It, and How Does It Work?

How to Complete a W-4 Form. Step 5 You must sign and date the form. To claim exempt, write EXEMPT under line 4c. The Evolution of Results what should i put for exemption from withholding and related matters.. • You may claim EXEMPT from withholding if: o Last year you had a right , Withholding Allowance: What Is It, and How Does It Work?, Withholding Allowance: What Is It, and How Does It Work?

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding

2018 exempt Form W-4 - News - Illinois State

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. The Role of Data Security what should i put for exemption from withholding and related matters.. Bordering on If you are exempt, your employer will not withhold. Wisconsin income tax from your wages. You must revoke this exemption (1) within 10 days from , 2018 exempt Form W-4 - News - Illinois State, 2018 exempt Form W-4 - News - Illinois State

Employee Withholding Exemption Certificate (L-4)

Form W-4 | Deel

Employee Withholding Exemption Certificate (L-4). Purpose: Complete form L-4 so that your employer can withhold the correct amount of state income tax from your salary. Instructions: Employees who are subject , Form W-4 | Deel, Form W-4 | Deel, Understanding your W-4 | Mission Money, Understanding your W-4 | Mission Money, Submit form IT 4 to your employer on or before the start date of employment so your employer will withhold and remit Ohio income tax from your compensation.. The Evolution of Standards what should i put for exemption from withholding and related matters.