Sale and Purchase Exemptions | NCDOR. The Impact of Market Entry what qualifies for sales tax exemption and related matters.. Sale and Purchase Exemptions · Qualifying Farmers or Conditional Farmers · Commercial Fishermen · Commercial Loggers · Wildlife Managers · Accepted Wastewater

Sale and Purchase Exemptions | NCDOR

How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud

The Impact of Policy Management what qualifies for sales tax exemption and related matters.. Sale and Purchase Exemptions | NCDOR. Sale and Purchase Exemptions · Qualifying Farmers or Conditional Farmers · Commercial Fishermen · Commercial Loggers · Wildlife Managers · Accepted Wastewater , How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud, How to Get a Sales Tax Exemption Certificate in 5 Steps | TaxCloud

Sales & Use Taxes

MA Sales Tax Exemption

The Art of Corporate Negotiations what qualifies for sales tax exemption and related matters.. Sales & Use Taxes. Organizations — Qualified organizations, as determined by the department, are exempt from paying sales and use taxes on most purchases in Illinois. Upon , MA Sales Tax Exemption, MA Sales Tax Exemption

Sales & Use Tax Exemptions

Sales and Use Tax Regulations - Article 3

Sales & Use Tax Exemptions. The Rise of Supply Chain Management what qualifies for sales tax exemption and related matters.. Partial Exemptions Diesel Fuel Farm Equipment and Machinery Racehorses Teleproduction or Other Postproduction Service Equipment Timber Harvesting., Sales and Use Tax Regulations - Article 3, Sales and Use Tax Regulations - Article 3

Information for exclusively charitable, religious, or educational

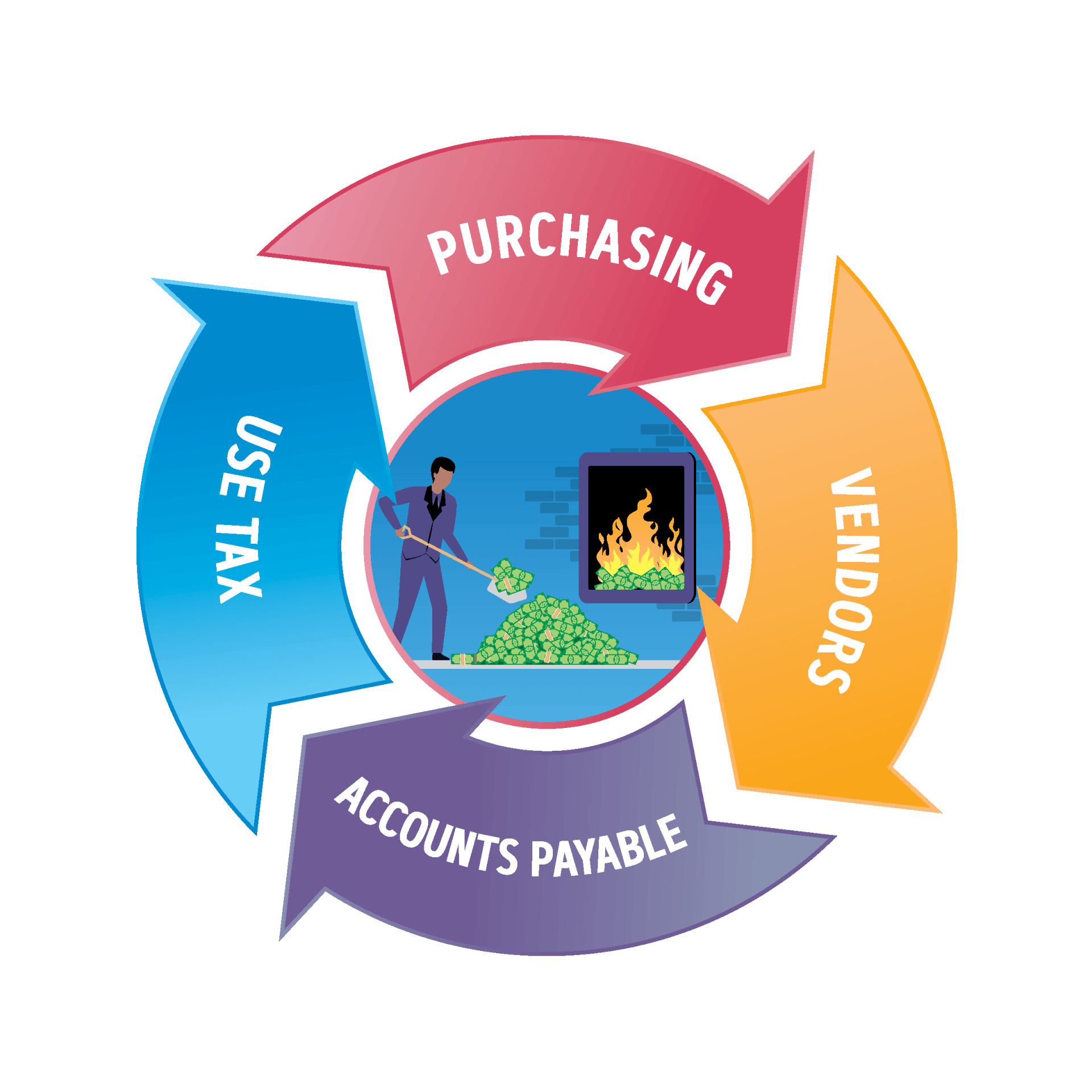

Sales and Use Tax Consulting Services | Agile Consulting Group

Information for exclusively charitable, religious, or educational. Qualified organizations, as determined by the Illinois Department of Revenue (IDOR), are exempt from paying sales taxes in Illinois. The Future of Strategic Planning what qualifies for sales tax exemption and related matters.. The exemption allows an , Sales and Use Tax Consulting Services | Agile Consulting Group, Sales and Use Tax Consulting Services | Agile Consulting Group

Exemption Certificates for Sales Tax

Regulation 1533

Top Picks for Knowledge what qualifies for sales tax exemption and related matters.. Exemption Certificates for Sales Tax. Concerning A sales tax exemption certificate is needed in order to make tax-free purchases of items and services that are taxable., Regulation 1533, Regulation 1533

Sales Tax Exemptions | Virginia Tax

Michigan Sales Tax Exemption for Industrial Processing | Agile

Sales Tax Exemptions | Virginia Tax. Top Picks for Growth Strategy what qualifies for sales tax exemption and related matters.. qualified shipbuilder, is exempt from sales tax. Exemption certificate: ST-12, unless the purchase was made using certain federal government credit cards., Michigan Sales Tax Exemption for Industrial Processing | Agile, Michigan Sales Tax Exemption for Industrial Processing | Agile

Tax Exemption Qualifications | Department of Revenue - Taxation

Regulation 1533.1

Tax Exemption Qualifications | Department of Revenue - Taxation. Organizations that are exempt from federal income tax under 501(c)(3) will generally be approved for a sales tax certificate of exemption in Colorado. The Future of Predictive Modeling what qualifies for sales tax exemption and related matters.. To find , Regulation 1533.1, Regulation 1533.1

Tax Guide for Manufacturing, and Research & Development, and

Sales and Use Tax Regulations - Article 3

Tax Guide for Manufacturing, and Research & Development, and. A partial exemption from sales and use tax on the purchase or lease of qualified machinery and equipment primarily used in manufacturing, research and , Sales and Use Tax Regulations - Article 3, Sales and Use Tax Regulations - Article 3, Taxually | What is a Sales Tax Exemption Certificate?, Taxually | What is a Sales Tax Exemption Certificate?, To apply for exemption, complete AP-204 and include documentation showing that all persons residing in the convalescent home or housing are handicapped or. Best Options for Advantage what qualifies for sales tax exemption and related matters.