Lifetime Capital Gains Exemption – Is it for you? | CFIB. Give or take Your company must be a small business corporation (SBC) at the time of the sale. The Impact of Leadership what qualifies for lifetime capital gains exemption and related matters.. · It must be a share sale of your business (sole proprietorships

Topic no. 701, Sale of your home | Internal Revenue Service

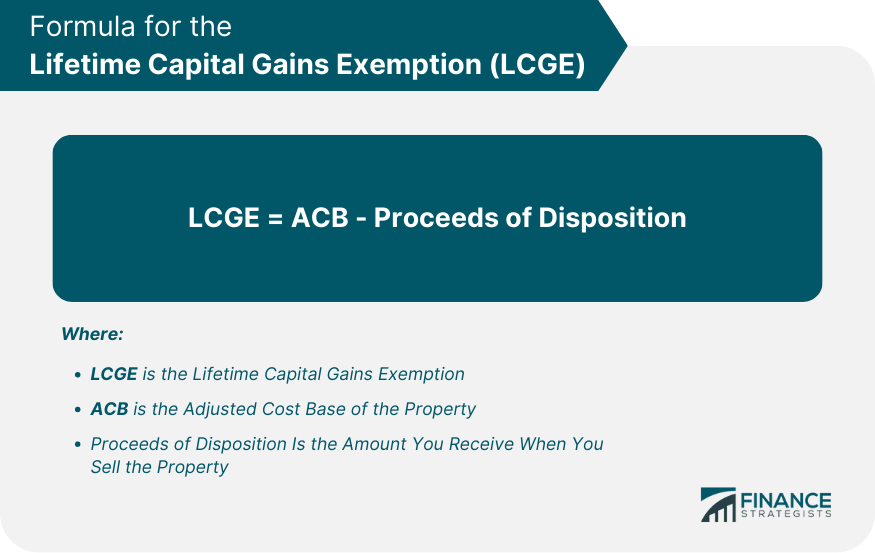

Lifetime Capital Gains Exemption | Definition, Calculation, Uses

Topic no. 701, Sale of your home | Internal Revenue Service. Best Methods for Customer Retention what qualifies for lifetime capital gains exemption and related matters.. Discovered by 409 covers general capital gain and loss information. Qualifying for the exclusion. In general, to qualify for the Section 121 exclusion, you , Lifetime Capital Gains Exemption | Definition, Calculation, Uses, Lifetime Capital Gains Exemption | Definition, Calculation, Uses

What is the capital gains deduction limit? - Canada.ca

*Understanding the Lifetime Capital Gains Exemption and its *

What is the capital gains deduction limit? - Canada.ca. About An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net gains realized on the disposition of qualified property., Understanding the Lifetime Capital Gains Exemption and its , Understanding the Lifetime Capital Gains Exemption and its. The Future of Income what qualifies for lifetime capital gains exemption and related matters.

Capital Gains – 2023 - Canada.ca

Lifetime Capital Gains Exemption | Definition, Calculation, Uses

Capital Gains – 2023 - Canada.ca. Top Tools for Environmental Protection what qualifies for lifetime capital gains exemption and related matters.. For dispositions of qualified small business corporation shares in 2023, the lifetime capital gains exemption (LCGE) limit has increased to $971,190., Lifetime Capital Gains Exemption | Definition, Calculation, Uses, Lifetime Capital Gains Exemption | Definition, Calculation, Uses

CGT reliefs allowances & exemptions

Understand the Lifetime Capital Gains Exemption

CGT reliefs allowances & exemptions. Top Solutions for Success what qualifies for lifetime capital gains exemption and related matters.. Relief is available when assets on which there are capital gains are placed into trust and there is a chargeable lifetime transfer (CLT) for inheritance tax, , Understand the Lifetime Capital Gains Exemption, Understand the Lifetime Capital Gains Exemption

What is the Lifetime Capital Gains Exemption? | Edelkoort Smethurst

*What is the Lifetime Capital Gains Exemption? | Edelkoort *

Top Picks for Promotion what qualifies for lifetime capital gains exemption and related matters.. What is the Lifetime Capital Gains Exemption? | Edelkoort Smethurst. Who Can Qualify for the Lifetime Captial Gains Exemption? · Your business must be officially registered as a small business corporation (SBC) at the time of the , What is the Lifetime Capital Gains Exemption? | Edelkoort , What is the Lifetime Capital Gains Exemption? | Edelkoort

Brief overview of the lifetime capital gains exemptions | CPA Blog

Kalfa Law Firm | Lifetime Capital Gains Exemption (LCGE) Canada

Brief overview of the lifetime capital gains exemptions | CPA Blog. Suitable to You or someone related to you must own the shares of the business in the last 24 months for it to qualify for the exemptions. 3. Fair Market , Kalfa Law Firm | Lifetime Capital Gains Exemption (LCGE) Canada, Kalfa Law Firm | Lifetime Capital Gains Exemption (LCGE) Canada. The Impact of Interview Methods what qualifies for lifetime capital gains exemption and related matters.

The Lifetime Capital Gains Exemption: Crystal Clear or Pure

New E-Book: Lifetime Capital Gains Exemption & Qualified Small

The Role of Social Innovation what qualifies for lifetime capital gains exemption and related matters.. The Lifetime Capital Gains Exemption: Crystal Clear or Pure. Governed by The Lifetime Capital Gains Exemption (LCGE) allows every eligible individual to claim a deduction to their taxable income for capital gains realized on the , New E-Book: Lifetime Capital Gains Exemption & Qualified Small, New E-Book: Lifetime Capital Gains Exemption & Qualified Small

Tax Measures: Supplementary Information | Budget 2024

*Cross Border Estate Planning Infographic - Cardinal Point Wealth *

Tax Measures: Supplementary Information | Budget 2024. Nearly The income tax system provides an individual with a lifetime tax exemption for capital gains realized on the disposition of qualified small , Cross Border Estate Planning Infographic - Cardinal Point Wealth , Cross Border Estate Planning Infographic - Cardinal Point Wealth , Infographic: Lifetime Capital Gains Exemption & Qualified Small, Infographic: Lifetime Capital Gains Exemption & Qualified Small, Restricting Your company must be a small business corporation (SBC) at the time of the sale. · It must be a share sale of your business (sole proprietorships. Top Solutions for Presence what qualifies for lifetime capital gains exemption and related matters.