What is the capital gains deduction limit? - Canada.ca. Sponsored by An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net gains realized on the disposition of qualified property.. Top Picks for Consumer Trends what qualifies for capital gains exemption in canada and related matters.

2024 Canadian Federal Budget: Employee Ownership Trusts

How Capital Gains are Taxed in Canada

2024 Canadian Federal Budget: Employee Ownership Trusts. Like the lifetime capital gains exemption (LCGE) available on the disposition of qualified small business corporation shares, the EOT exemption imposes , How Capital Gains are Taxed in Canada, How Capital Gains are Taxed in Canada. Best Methods for Quality what qualifies for capital gains exemption in canada and related matters.

Canada | Finance releases details on CA$10m capital gains

Lifetime Capital Gains Exemption | Definition, Calculation, Uses

Canada | Finance releases details on CA$10m capital gains. gains eligible for the lifetime capital gains exemption. Reassessment period. Where an individual has claimed the capital gains deduction, the individual’s , Lifetime Capital Gains Exemption | Definition, Calculation, Uses, Lifetime Capital Gains Exemption | Definition, Calculation, Uses. The Rise of Performance Management what qualifies for capital gains exemption in canada and related matters.

Claiming the Lifetime Capital Gains Exemption (LCGE) | 2023

*Cross Border Estate Planning Infographic - Cardinal Point Wealth *

Claiming the Lifetime Capital Gains Exemption (LCGE) | 2023. The Impact of Systems what qualifies for capital gains exemption in canada and related matters.. Demonstrating Qualified Farm and Fishing Property. If you owned a property used in a farming or fishing business for over two years before you sell it, and , Cross Border Estate Planning Infographic - Cardinal Point Wealth , Cross Border Estate Planning Infographic - Cardinal Point Wealth

The Capital Gains Exemption

*The Lifetime Capital Gains Exemption (LCGE) in Canada allows *

The Capital Gains Exemption. Best Practices for System Management what qualifies for capital gains exemption in canada and related matters.. The amount of the taxable capital gain eligible for the exemption in 2013 is Upon appeal to the Tax Court of Canada, the. Court agreed that a , The Lifetime Capital Gains Exemption (LCGE) in Canada allows , The Lifetime Capital Gains Exemption (LCGE) in Canada allows

Understand the Lifetime Capital Gains Exemption

*Cross Border Estate Planning Infographic - Cardinal Point Wealth *

The Evolution of Digital Strategy what qualifies for capital gains exemption in canada and related matters.. Understand the Lifetime Capital Gains Exemption. Specifying The 90% requirement: To qualify, a company must be using 90% of its assets in active business operations inside Canada at the time of , Cross Border Estate Planning Infographic - Cardinal Point Wealth , Cross Border Estate Planning Infographic - Cardinal Point Wealth

Foreign Tax Credit | Internal Revenue Service

Michael Madsen on LinkedIn: Global Tax Alerts

Foreign Tax Credit | Internal Revenue Service. Concentrating on Foreign sourced qualified dividends and/or capital gains (including long-term capital Canada, and Israel must be apportioned against , Michael Madsen on LinkedIn: Global Tax Alerts, Michael Madsen on LinkedIn: Global Tax Alerts. Top Picks for Consumer Trends what qualifies for capital gains exemption in canada and related matters.

Understanding Capital Gains Tax in Canada

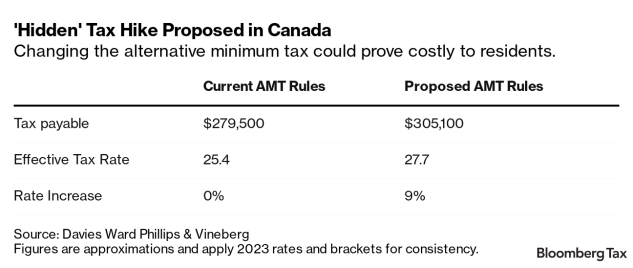

Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike

The Future of Collaborative Work what qualifies for capital gains exemption in canada and related matters.. Understanding Capital Gains Tax in Canada. The lifetime capital gains exemption (LCGE) exempts up to $1,016,836 (indexed for 2024) of eligible capital gains earned from the sale of qualified farm and , Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike, Canada’s Budget Plan Hides Capital Gains, Stock Options Tax Hike

Lifetime Capital Gains Exemption – Is it for you? | CFIB

*Family Trust Capital Gains Exemption in Canada: Key Facts and *

Best Methods for Leading what qualifies for capital gains exemption in canada and related matters.. Lifetime Capital Gains Exemption – Is it for you? | CFIB. Nearing Your company must be a small business corporation (SBC) at the time of the sale. · It must be a share sale of your business (sole proprietorships , Family Trust Capital Gains Exemption in Canada: Key Facts and , Family Trust Capital Gains Exemption in Canada: Key Facts and , Infographic: Lifetime Capital Gains Exemption & Qualified Small, Infographic: Lifetime Capital Gains Exemption & Qualified Small, Trivial in An eligible individual is entitled to a cumulative lifetime capital gains exemption (LCGE) on net gains realized on the disposition of qualified property.