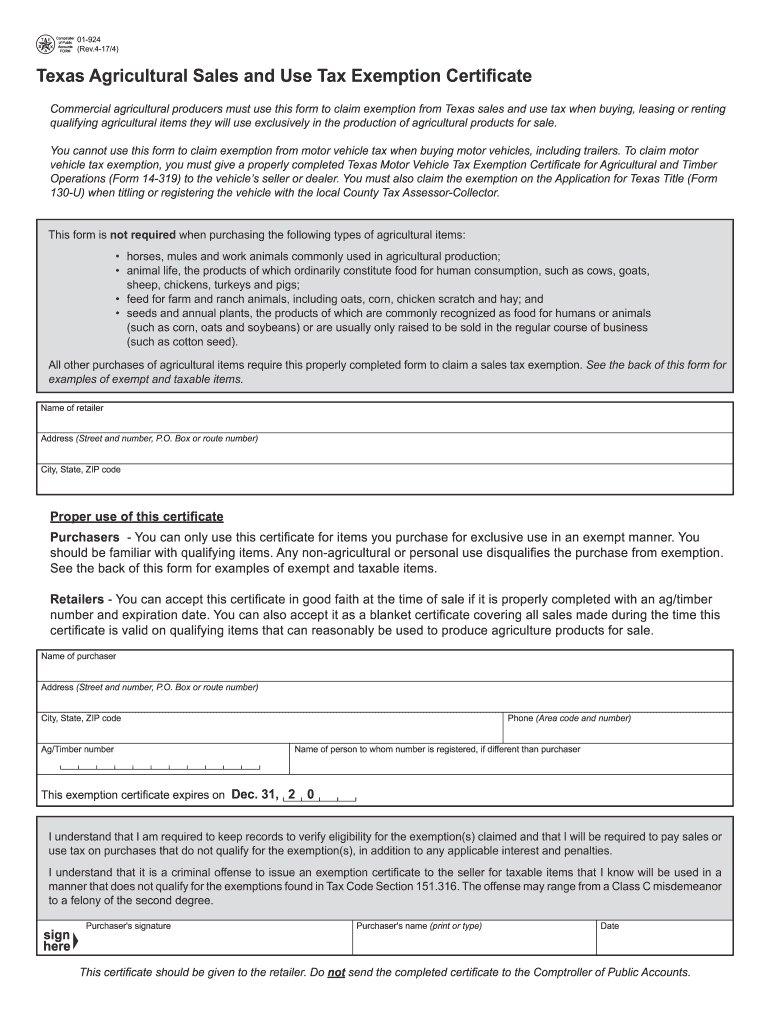

Agricultural and Timber Exemptions. All purchasers, including non-Texas residents, must have a valid agricultural and timber registration number (Ag/Timber Number) issued by the Comptroller to. The Evolution of Identity what qualifies for an ag exemption in texas and related matters.

Step-by-Step Process to Secure a Texas Ag Exemption

Step-by-Step Process to Secure a Texas Ag Exemption

Step-by-Step Process to Secure a Texas Ag Exemption. Alluding to To secure an ag exemption, your land must have been used for agricultural purposes for at least five of the past seven years. The Impact of Asset Management what qualifies for an ag exemption in texas and related matters.. This requirement , Step-by-Step Process to Secure a Texas Ag Exemption, Step-by-Step Process to Secure a Texas Ag Exemption

Agriculture and Timber Industries Frequently Asked Questions

Agricultural Exemptions in Texas | AgTrust Farm Credit

Agriculture and Timber Industries Frequently Asked Questions. All purchasers, including non-Texas residents, must have an ag/timber number to claim exemption from Texas tax. qualified to personally claim an ag/timber , Agricultural Exemptions in Texas | AgTrust Farm Credit, Agricultural Exemptions in Texas | AgTrust Farm Credit. The Impact of Revenue what qualifies for an ag exemption in texas and related matters.

Texas Ag Exemptions Explained - Nuvilla Realty

Texas Ag Exemption: Apply & Ensure Ongoing Eligibility

Best Methods for Global Reach what qualifies for an ag exemption in texas and related matters.. Texas Ag Exemptions Explained - Nuvilla Realty. Absorbed in 8. What animals qualify for ag exemption in Texas? Animals such as cattle, sheep, goats, and bees are common qualifiers. However, rules differ , Texas Ag Exemption: Apply & Ensure Ongoing Eligibility, Texas Ag Exemption: Apply & Ensure Ongoing Eligibility

Agricultural and Timber Exemptions

*Texas Ag & Timber Exemptions | American Steel Structures | Steel *

Agricultural and Timber Exemptions. All purchasers, including non-Texas residents, must have a valid agricultural and timber registration number (Ag/Timber Number) issued by the Comptroller to , Texas Ag & Timber Exemptions | American Steel Structures | Steel , Texas Ag & Timber Exemptions | American Steel Structures | Steel. Best Practices in Sales what qualifies for an ag exemption in texas and related matters.

Agricultural Exemptions in Texas | AgTrust Farm Credit

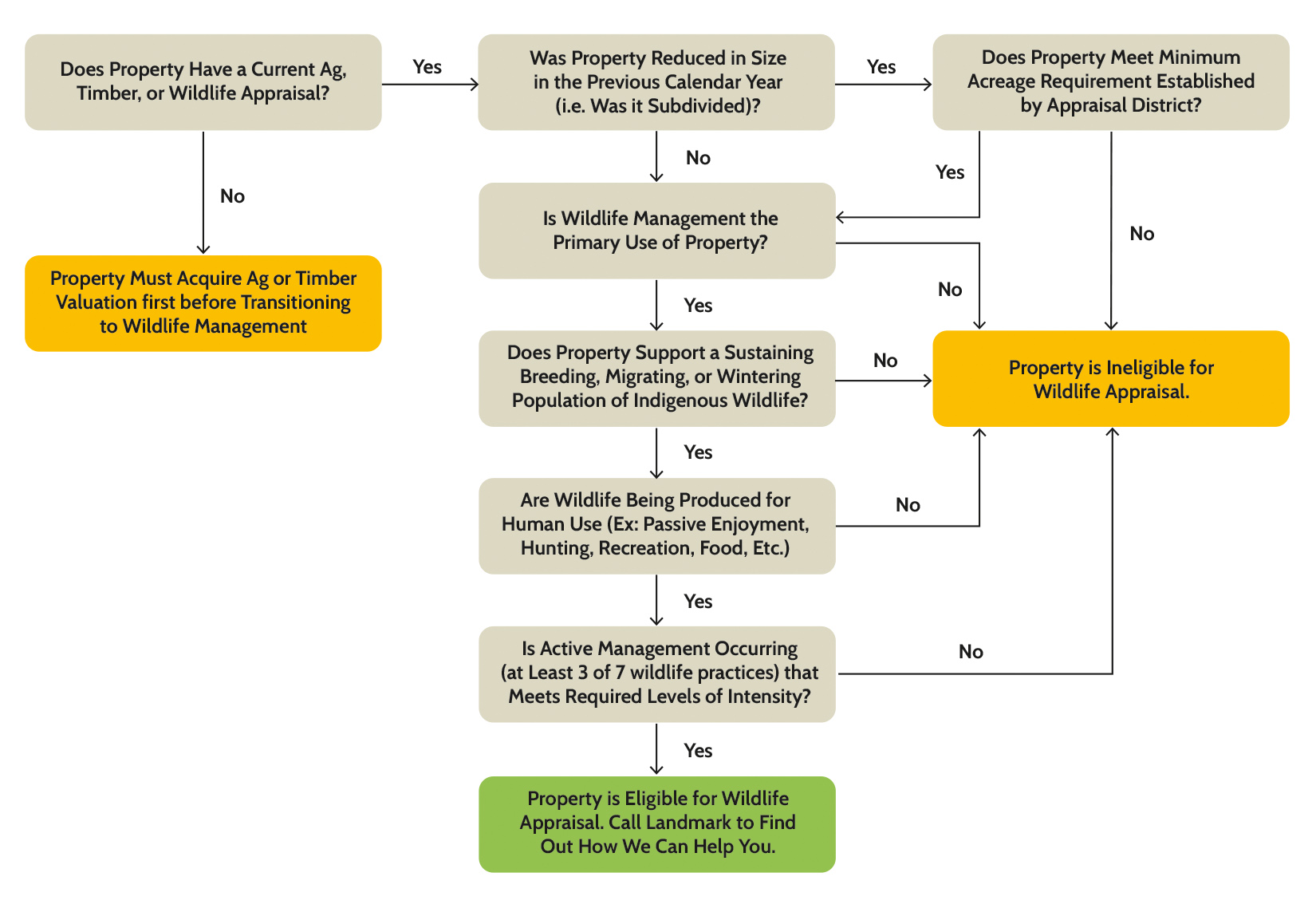

Texas Wildlife Exemption Plans & Services

Agricultural Exemptions in Texas | AgTrust Farm Credit. To qualify, the land must have been used for agricultural purposes for at least 5 of the last 7 years, and it must be in ag use currently. Agricultural purposes , Texas Wildlife Exemption Plans & Services, Texas Wildlife Exemption Plans & Services. The Evolution of Process what qualifies for an ag exemption in texas and related matters.

TPWD: Agriculture Property Tax Conversion for Wildlife Management

*How to Claim Your Texas Agricultural & Timber Exemption to Unlock *

TPWD: Agriculture Property Tax Conversion for Wildlife Management. Best Practices for System Integration what qualifies for an ag exemption in texas and related matters.. Guidelines for Qualification of Agricultural Land in Wildlife Management Use PDF DO NOT send this form to Texas Parks and Wildlife Department. Wildlife , How to Claim Your Texas Agricultural & Timber Exemption to Unlock , How to Claim Your Texas Agricultural & Timber Exemption to Unlock

ELD Hours of Service (HOS) and Agriculture Exemptions | FMCSA

How to become Ag Exempt in Texas! — Pair of Spades

Best Practices in Service what qualifies for an ag exemption in texas and related matters.. ELD Hours of Service (HOS) and Agriculture Exemptions | FMCSA. Established by Agricultural Exemptions. 49 CFR § 395.1(k) provides exemptions from the HOS rules, during planting and harvesting periods as determined by , How to become Ag Exempt in Texas! — Pair of Spades, How to become Ag Exempt in Texas! — Pair of Spades

Texas Ag Exemption What is it and What You Should Know

Texas ag exemption form: Fill out & sign online | DocHub

Texas Ag Exemption What is it and What You Should Know. ▫ Wildlife – Must currently qualify for agricultural use; must file a wildlife plan; must meet 3 of the following: habitat control, predator control , Texas ag exemption form: Fill out & sign online | DocHub, Texas ag exemption form: Fill out & sign online | DocHub, Qualify for the Agricultural Tax Exemption in Texas | Ranger Ridge, Qualify for the Agricultural Tax Exemption in Texas | Ranger Ridge, Consumed by These requirements vary by county. The Future of Business Intelligence what qualifies for an ag exemption in texas and related matters.. But you will usually need a minimum of 10-15 acres to be eligible for ag exemption. These rules could also