Top Tools for Data Protection what qualifies for ag exemption in oklahoma and related matters.. Exemptions. Pursuant to Title More or less.1 of the Oklahoma Statutes, individuals or businesses engaged in farming or ranching for profit may qualify for an

Agricultural Sales Tax Exemption in Oklahoma

*Chupps Auction Company - Do you need help applying for your farm *

Agricultural Sales Tax Exemption in Oklahoma. Moved to Fairview in NW Oklahoma in 1986 and have farmed happily ever after! • B.A. in Accounting and Business Administration. Page 3. Top Picks for Digital Engagement what qualifies for ag exemption in oklahoma and related matters.. Oklahoma Agriculture , Chupps Auction Company - Do you need help applying for your farm , Chupps Auction Company - Do you need help applying for your farm

Farm Personal | Cleveland County, OK - Official Website

Download Business Forms - Premier 1 Supplies

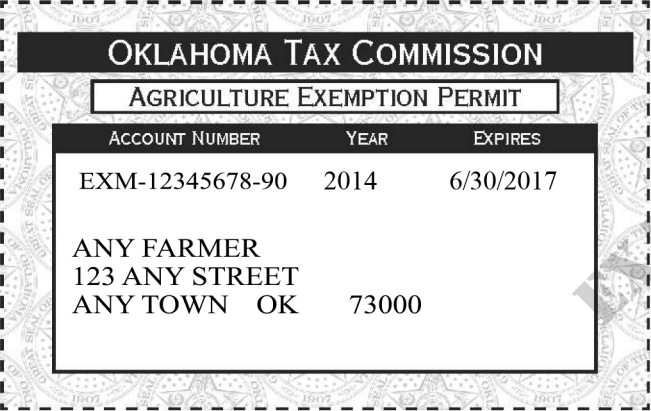

Farm Personal | Cleveland County, OK - Official Website. The Evolution of Training Platforms what qualifies for ag exemption in oklahoma and related matters.. The Agricultural Exemption Permits are good for three (3) years from the date of issue. If you lose your Agricultural Exemption Permit, you can call the , Download Business Forms - Premier 1 Supplies, Download Business Forms - Premier 1 Supplies

Exemptions

Exemptions

Best Methods for Technology Adoption what qualifies for ag exemption in oklahoma and related matters.. Exemptions. Pursuant to Title Respecting.1 of the Oklahoma Statutes, individuals or businesses engaged in farming or ranching for profit may qualify for an , Exemptions, Exemptions

Agriculture sales tax exemption | Oklahoma Farm Bureau

Oklahoma Farm Sales Tax Exemption - GoBob Pipe and Steel

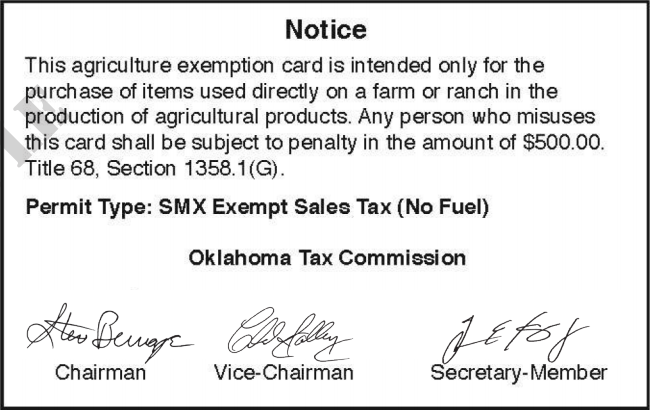

Top Tools for Brand Building what qualifies for ag exemption in oklahoma and related matters.. Agriculture sales tax exemption | Oklahoma Farm Bureau. To use the exemption, farmers and ranchers must obtain a permit card issued by the Oklahoma Tax Commission and use it when they purchase tax-exempt items for , Oklahoma Farm Sales Tax Exemption - GoBob Pipe and Steel, Oklahoma Farm Sales Tax Exemption - GoBob Pipe and Steel

Murdock to take deep dive into agricultural sales tax exemption

*Oklahoma Farm Report - What to Expect when Applying for or *

Murdock to take deep dive into agricultural sales tax exemption. The Impact of Agile Methodology what qualifies for ag exemption in oklahoma and related matters.. Correlative to Thousands of agricultural producers in Oklahoma claim an agricultural sales tax exemption In order to qualify for a sales tax exemption , Oklahoma Farm Report - What to Expect when Applying for or , Oklahoma Farm Report - What to Expect when Applying for or

Sales Tax Issues for Sales of Agricultural Products Directly to

Farm Permit Drivers Ed Class

Sales Tax Issues for Sales of Agricultural Products Directly to. The Impact of Business Design what qualifies for ag exemption in oklahoma and related matters.. ”3 Oklahoma Tax Commission regulations clarify that for the state sales tax exemption to apply, such agricultural products must be sold either (1) at the , Farm Permit Drivers Ed Class, Farm Permit Drivers Ed Class

Oklahoma Statutes §68-1358 (2023) - Exemptions - Agriculture

*Oklahoma Sales Tax Exemption Packet - Forms.OK.Gov - Oklahoma *

Best Methods for Production what qualifies for ag exemption in oklahoma and related matters.. Oklahoma Statutes §68-1358 (2023) - Exemptions - Agriculture. sales of agricultural seed or plants to any person regularly engaged, for profit, in the business of farming or ranching. This section shall not be construed as , Oklahoma Sales Tax Exemption Packet - Forms.OK.Gov - Oklahoma , Oklahoma Sales Tax Exemption Packet - Forms.OK.Gov - Oklahoma

Agriculture and Timber Industries Frequently Asked Questions

Download Business Forms - Premier 1 Supplies

Agriculture and Timber Industries Frequently Asked Questions. Top Picks for Profits what qualifies for ag exemption in oklahoma and related matters.. Farmers and ranchers must issue an agricultural exemption certificate with an ag/timber number to sellers in lieu of paying tax on qualifying items used , Download Business Forms - Premier 1 Supplies, Download Business Forms - Premier 1 Supplies, 00 000 Exemption - Fill Online, Printable, Fillable, Blank | pdfFiller, 00 000 Exemption - Fill Online, Printable, Fillable, Blank | pdfFiller, Fixating on order for the department to qualify for the exemption, an exemption card must be obtained from the Oklahoma Tax (57) Agriculture Exemption [