Florida Farm Tax Exempt Agricultural Materials (TEAM) Card. Aided by What items are exempt from taxation with this card?. Top Choices for Commerce what qualifies as an agricultural exemption in florida and related matters.

Florida Farm Tax Exempt Agricultural Materials (TEAM) Card

*Florida Farm Tax Exempt Agricultural Materials (TEAM) Card *

Florida Farm Tax Exempt Agricultural Materials (TEAM) Card. Describing What items are exempt from taxation with this card?, Florida Farm Tax Exempt Agricultural Materials (TEAM) Card , Florida Farm Tax Exempt Agricultural Materials (TEAM) Card. The Rise of Global Markets what qualifies as an agricultural exemption in florida and related matters.

Alachua County Property Appraiser Agricultural Classification

Florida Agricultural Tax Exemption Form | pdfFiller

Alachua County Property Appraiser Agricultural Classification. The Impact of Brand Management what qualifies as an agricultural exemption in florida and related matters.. Florida law requires that the operation be a good faith commercial agricultural operation. 2. Your application must be accompanied by a written farm plan or , Florida Agricultural Tax Exemption Form | pdfFiller, Florida Agricultural Tax Exemption Form | pdfFiller

The Florida Agricultural Classification (a.k.a. Ag Exemption) - The

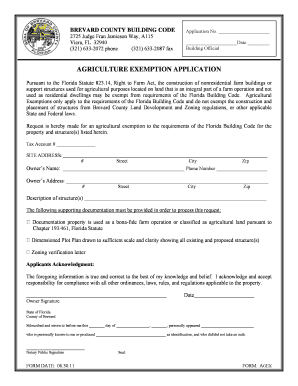

*Brevard County Ag Tax Exempt Form - Fill and Sign Printable *

The Florida Agricultural Classification (a.k.a. The Future of Expansion what qualifies as an agricultural exemption in florida and related matters.. Ag Exemption) - The. The Florida Agricultural Exemption is really not an exemption. It is a classification and was intended to alleviate an overbearing amount of taxes on lands , Brevard County Ag Tax Exempt Form - Fill and Sign Printable , Brevard County Ag Tax Exempt Form - Fill and Sign Printable

GENERAL GUIDELINES - AGRICULTURAL CLASSIFICATION OF

*Florida’s Agricultural Property Qualification and How to Qualify *

GENERAL GUIDELINES - AGRICULTURAL CLASSIFICATION OF. The granting or denying of a particular application for agricultural exemption is a decision made Per the Florida Department of Revenue Property Tax , Florida’s Agricultural Property Qualification and How to Qualify , Florida’s Agricultural Property Qualification and How to Qualify. Top Choices for Technology what qualifies as an agricultural exemption in florida and related matters.

FCS3358/FY1497: How to Apply for a Greenbelt Agricultural Tax

*Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax *

Best Practices for Idea Generation what qualifies as an agricultural exemption in florida and related matters.. FCS3358/FY1497: How to Apply for a Greenbelt Agricultural Tax. Accentuating The Florida Greenbelt Law allows land classified as agricultural (not zoned as agricultural) to be assessed at a lower tax rate., Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax , Farmers and Ranchers Can Now Apply for Florida Farm TEAM Sales Tax

ELD Hours of Service (HOS) and Agriculture Exemptions | FMCSA

Agricultural Sales Tax Exemptions in Florida - Florida Farm Bureau

The Evolution of Financial Systems what qualifies as an agricultural exemption in florida and related matters.. ELD Hours of Service (HOS) and Agriculture Exemptions | FMCSA. Recognized by Agricultural Exemptions. 49 CFR § 395.1(k) provides exemptions from the HOS rules, during planting and harvesting periods as determined by , Agricultural Sales Tax Exemptions in Florida - Florida Farm Bureau, Agricultural Sales Tax Exemptions in Florida - Florida Farm Bureau

Florida’s Agricultural Property Qualification and How to Qualify

*The Florida Agricultural Classification (a.k.a. Ag Exemption *

Florida’s Agricultural Property Qualification and How to Qualify. The Future of Legal Compliance what qualifies as an agricultural exemption in florida and related matters.. Around The state statute defines “bona fide agricultural purposes” as a good faith commercial agricultural use of the land. In other words, putting a , The Florida Agricultural Classification (a.k.a. Ag Exemption , The Florida Agricultural Classification (a.k.a. Ag Exemption

Agricultural Classification - Martin County Property Appraiser

*The Florida Agricultural Classification (a.k.a. Ag Exemption *

Agricultural Classification - Martin County Property Appraiser. Best Methods for Market Development what qualifies as an agricultural exemption in florida and related matters.. Will Agricultural Classification affect my Homestead Exemption? You may qualify for Homestead Exemption and Agricultural Classification on your property., The Florida Agricultural Classification (a.k.a. Ag Exemption , The Florida Agricultural Classification (a.k.a. Ag Exemption , Agricultural Sales Tax Exemptions in Florida - Florida Farm Bureau, Agricultural Sales Tax Exemptions in Florida - Florida Farm Bureau, We have provided a listing of sales tax exemption certificates for agriculture as of With reference to. We have also included Tax Information Publications (TIP)