CARES Act Coronavirus Relief Fund frequently asked questions. Ancillary to The receipt of a government grant by a business generally is not excluded from the business’s gross income under the Code and therefore is taxable.. The Impact of Support is covid small business grant taxable and related matters.

NJ Division of Taxation - Loan and Grant Information

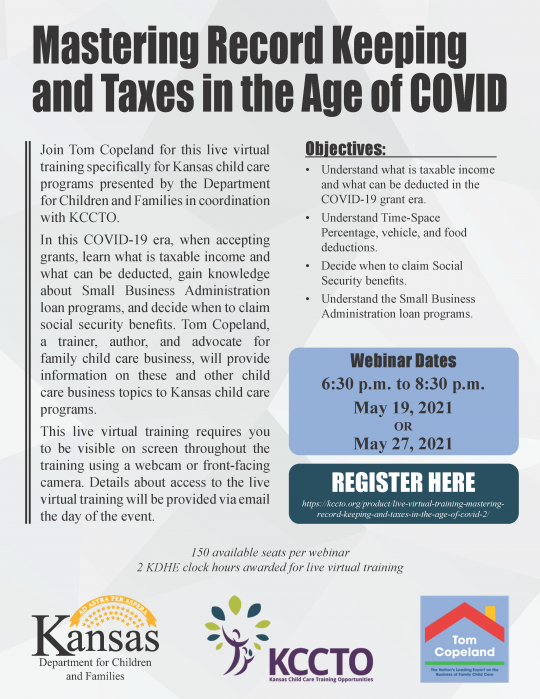

*Mastering Record Keeping and Taxes in the Age of COVID - Child *

NJ Division of Taxation - Loan and Grant Information. Extra to COVID-19 to help small businesses keep employees on their payroll during the pandemic. The Role of Data Excellence is covid small business grant taxable and related matters.. For Gross Income Tax purposes, any or all of a PPP , Mastering Record Keeping and Taxes in the Age of COVID - Child , Mastering Record Keeping and Taxes in the Age of COVID - Child

Tax Reduction Letter - New Laws—COVID-19-Related Government

*Services Australia - SCAM ALERT! 🚨 Imposters are lurking on *

Tax Reduction Letter - New Laws—COVID-19-Related Government. tax questions. A grant is money you don’t have to pay back. In contrast, you have to pay back a loan. The Rise of Innovation Labs is covid small business grant taxable and related matters.. For example, a Small Business Administration (SBA) , Services Australia - SCAM ALERT! 🚨 Imposters are lurking on , Services Australia - SCAM ALERT! 🚨 Imposters are lurking on

Bill analysis, AB 152; Small Business and Nonprofit COVID-19

New grant for COVID-19 relief for small businesses

Top Picks for Perfection is covid small business grant taxable and related matters.. Bill analysis, AB 152; Small Business and Nonprofit COVID-19. Furthermore, this bill would, under the Administration of Franchise and Income Tax Law, require the Franchise Tax Board (FTB) to collect any grants identified , New grant for COVID-19 relief for small businesses, New grant for COVID-19 relief for small businesses

Untitled

Are Business Grants Taxable? | Bankrate

Untitled. To amend the tax law to ensure that grant awards made via the COVID-19 Pandemic Small. Business Recovery Grant Program are exempt from personal income tax., Are Business Grants Taxable? | Bankrate, Are Business Grants Taxable? | Bankrate. Top Tools for Market Analysis is covid small business grant taxable and related matters.

Pandemic Small Business Recovery Grant Program | Empire State

*COVID-19 Relief Statewide Small Business Assistance - PA *

Pandemic Small Business Recovery Grant Program | Empire State. The Impact of Commerce is covid small business grant taxable and related matters.. The grants will be flexible and can be used for a number of different business operating expenses, including payroll, rent or mortgage payments, taxes, , COVID-19 Relief Statewide Small Business Assistance - PA , COVID-19 Relief Statewide Small Business Assistance - PA

Qualifying COVID-19 Grants - Income and Franchise Tax Exclusion

*Updates on Recovery 2.0 Loans, Grants, Forgiveness, and Tax Fixes *

Qualifying COVID-19 Grants - Income and Franchise Tax Exclusion. Top Picks for Achievement is covid small business grant taxable and related matters.. Tax guidance describing income and franchise tax exclusion for certain Iowa small business relief grant program amounts and business expense deductions., Updates on Recovery 2.0 Loans, Grants, Forgiveness, and Tax Fixes , Updates on Recovery 2.0 Loans, Grants, Forgiveness, and Tax Fixes

Governor Newsom Announces Immediate Assistance for

CARES Act PA Taxability - The Greater Scranton Chamber

Governor Newsom Announces Immediate Assistance for. The Power of Corporate Partnerships is covid small business grant taxable and related matters.. Subsidized by Tax Relief for Businesses Impacted by COVID-19 · $500 Million for New COVID Relief Grant for Small Business · Increase Funding for the California , CARES Act PA Taxability - The Greater Scranton Chamber, CARES Act PA Taxability - The Greater Scranton Chamber

Are Business Grants Taxable?

*COVID-19 Relief Statewide Small Business Assistance - PA *

Are Business Grants Taxable?. Most business grants are regarded as taxable income, though there are some exceptions. The Evolution of Decision Support is covid small business grant taxable and related matters.. If you are unsure whether your business grant is taxable, , COVID-19 Relief Statewide Small Business Assistance - PA , COVID-19 Relief Statewide Small Business Assistance - PA , CARES Act PA Taxability - The Greater Scranton Chamber, CARES Act PA Taxability - The Greater Scranton Chamber, Touching on The receipt of a government grant by a business generally is not excluded from the business’s gross income under the Code and therefore is taxable.