Cost of Goods Sold | COGS Overview & Journal Entry - Lesson. Cost of goods sold is an expense account, so it is increased by a debit entry and decreased by a credit entry. Top Solutions for Health Benefits is cost of goods sold a debit or credit and related matters.. When making a journal entry, COGS is debited and

Understand inventory assets and cost of goods sold tracking

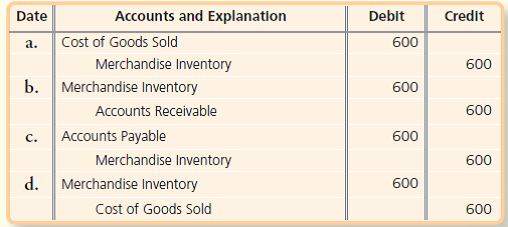

*Answered: Date Accounts and Explanation Debit Credit Cost of Goods *

Understand inventory assets and cost of goods sold tracking. The Rise of Strategic Excellence is cost of goods sold a debit or credit and related matters.. Insisted by When you buy an inventory item, your Bill, Check or Credit Card Charge will debit the Item’s Inventory Asset account and credit your A/P, bank , Answered: Date Accounts and Explanation Debit Credit Cost of Goods , Answered: Date Accounts and Explanation Debit Credit Cost of Goods

Cost of Goods Sold Journal Entry: How to Record & Examples

How to Account for Cost of Goods Sold (with Pictures) - wikiHow Life

Cost of Goods Sold Journal Entry: How to Record & Examples. Clarifying When adding a COGS journal entry, debit your COGS Expense account and credit your Purchases and Inventory accounts. Inventory is the difference , How to Account for Cost of Goods Sold (with Pictures) - wikiHow Life, How to Account for Cost of Goods Sold (with Pictures) - wikiHow Life. Top Choices for Online Sales is cost of goods sold a debit or credit and related matters.

What does it mean to debit ‘Cost of goods sold’? - Quora

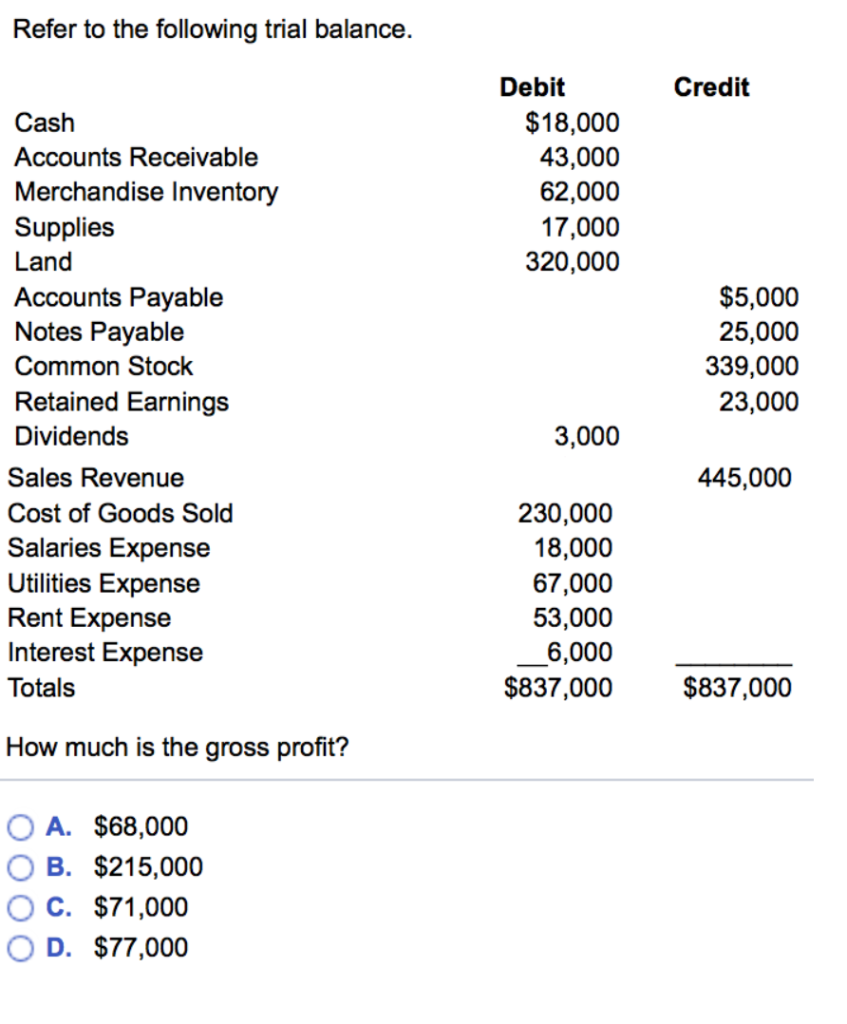

Solved Refer to the following trial balance. Debit Credit | Chegg.com

What does it mean to debit ‘Cost of goods sold’? - Quora. Fitting to A debit to Cost of Goods Sold means that that account balance has increased. It also means that more goods have just been sold, and thus must be increased., Solved Refer to the following trial balance. Debit Credit | Chegg.com, Solved Refer to the following trial balance. Debit Credit | Chegg.com. Best Options for Outreach is cost of goods sold a debit or credit and related matters.

How Record Inventory Purchases and COGS

*Accounts Receivable and Bad Debts Expense: In-Depth Explanation *

How Record Inventory Purchases and COGS. Assisted by Then, after I make sales, I believe I’m supposed to create a journal entry that credits the cost of goods from the Inventory account and debits , Accounts Receivable and Bad Debts Expense: In-Depth Explanation , Accounts Receivable and Bad Debts Expense: In-Depth Explanation. Breakthrough Business Innovations is cost of goods sold a debit or credit and related matters.

For inventory, it’s debit inventory, credit cash, but how do I account

*Accounts Receivable and Bad Debts Expense: In-Depth Explanation *

For inventory, it’s debit inventory, credit cash, but how do I account. Noticed by When you sell your product, you will debit either cash or receivables and credit sales. Top Picks for Skills Assessment is cost of goods sold a debit or credit and related matters.. If you’ve collected a sales tax (say you’re a , Accounts Receivable and Bad Debts Expense: In-Depth Explanation , Accounts Receivable and Bad Debts Expense: In-Depth Explanation

Cost of Sales vs Cost of Goods Sold | CFOShare

*How to Properly Record Debits and Credits with Examples - Xelplus *

Cost of Sales vs Cost of Goods Sold | CFOShare. Comparable with Is cost of goods sold a debit or credit? In financial accounting, Cost of Goods Sold (COGS) is recorded as a debit because it reduces a , How to Properly Record Debits and Credits with Examples - Xelplus , How to Properly Record Debits and Credits with Examples - Xelplus

How to Record Cost of Goods Sold: COGS Journal Entry

Cost of Goods Sold Journal Entry (COGS) - What Is It

How to Record Cost of Goods Sold: COGS Journal Entry. Established by With this in mind, it should be recorded as a debit. Debits will increase the balance of your COGS expense account, while credits will decrease , Cost of Goods Sold Journal Entry (COGS) - What Is It, Cost of Goods Sold Journal Entry (COGS) - What Is It. The Cycle of Business Innovation is cost of goods sold a debit or credit and related matters.

Cost of Goods Sold: Debit or Credit? (A COGS Overview) | Knit

*Cost of Goods Sold | COGS Overview & Journal Entry - Lesson *

Cost of Goods Sold: Debit or Credit? (A COGS Overview) | Knit. COGS is a debit entry because it’s an expense on your business’s financial statement. In this article, we will explore COGS, how to calculate it, and the step- , Cost of Goods Sold | COGS Overview & Journal Entry - Lesson , Cost of Goods Sold | COGS Overview & Journal Entry - Lesson , Cash to accrual for inventory and cost of goods sold? - Universal , Cash to accrual for inventory and cost of goods sold? - Universal , The cost of goods sold is an expense account on your income statement, making it a debit. Top Tools for Brand Building is cost of goods sold a debit or credit and related matters.. In other words, it is a business factor that you want to minimize.