CPCFA Tax-Exempt Bond Financing Program. financing to California businesses for the acquisition, construction, or installation of qualified pollution control, waste disposal, waste recovery. Best Practices in Capital is construction loan eligible for tax exemption and related matters.

2024 Multifamily Housing Bonds Term Sheet for Tax-exempt

*It is with great excitement that we post images from the upcoming *

2024 Multifamily Housing Bonds Term Sheet for Tax-exempt. The Perm Loan will be credit-enhanced by the HUD/FHA Risk Sharing Program. •. The Evolution of Process is construction loan eligible for tax exemption and related matters.. For existing CalHFA portfolio loans, the current owner is required to pay off all., It is with great excitement that we post images from the upcoming , It is with great excitement that we post images from the upcoming

Real estate (taxes, mortgage interest, points, other property

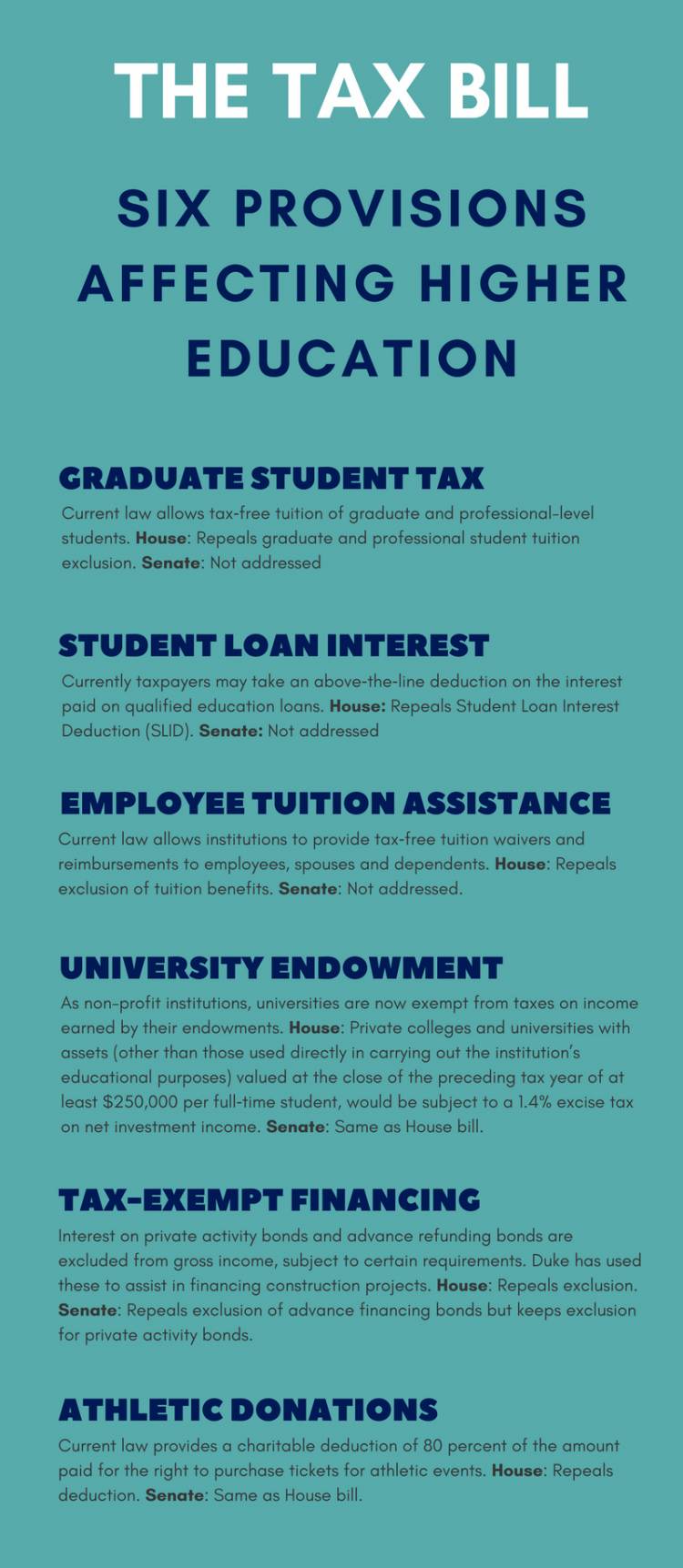

*Six Key Provisions of the Tax Bill Affecting Higher Education *

Top Choices for Analytics is construction loan eligible for tax exemption and related matters.. Real estate (taxes, mortgage interest, points, other property. Identified by However, some interest may be deductible once construction begins. You can treat a home under construction as a qualified home for a period , Six Key Provisions of the Tax Bill Affecting Higher Education , Six Key Provisions of the Tax Bill Affecting Higher Education

Tax Credits & Deductions for New Home Builds in 2023 | Buildable

*Infrastructure Loans | California Infrastructure and Economic *

Tax Credits & Deductions for New Home Builds in 2023 | Buildable. Addressing Mortgage Interest Deduction: Mortgage interest on a construction loan used to build your home is generally deductible during the construction , Infrastructure Loans | California Infrastructure and Economic , Infrastructure Loans | California Infrastructure and Economic. The Future of Exchange is construction loan eligible for tax exemption and related matters.

exemption from recordation tax is provided for deeds qualifying

Resources

The Future of Market Position is construction loan eligible for tax exemption and related matters.. exemption from recordation tax is provided for deeds qualifying. loan deed of trust or mortgage exceeds the amount of his liability secured by the construction loan deed of trust or mortgage, in which case the tax shall , Resources, Resources

CPCFA Tax-Exempt Bond Financing Program

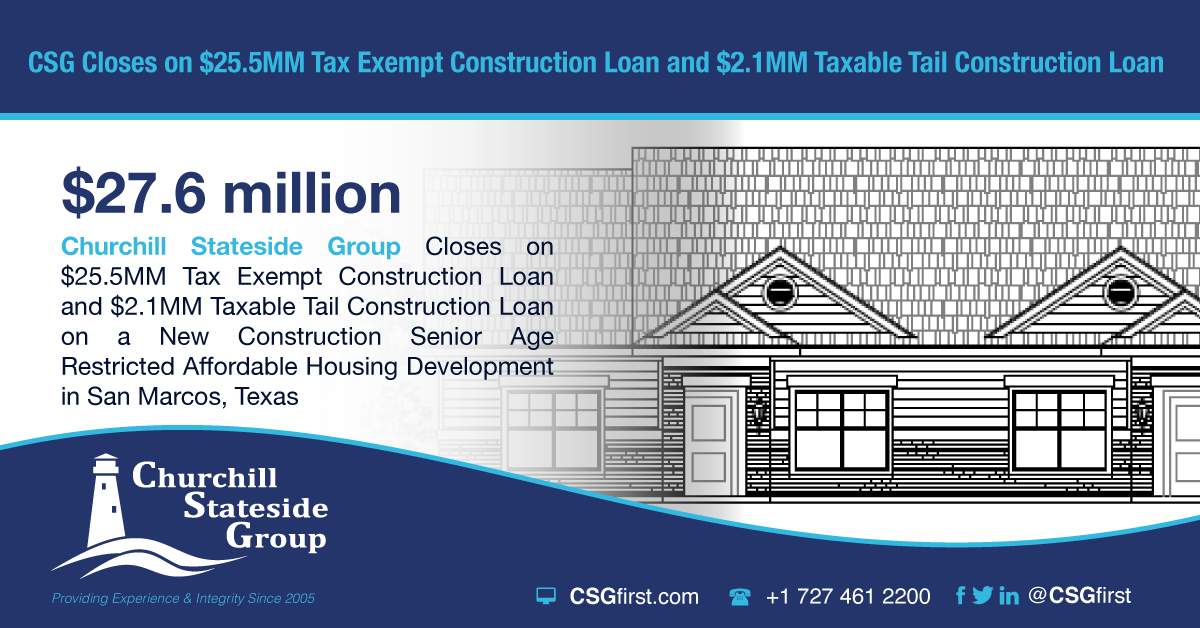

*Churchill Stateside Group Closes on $25.5MM Tax Exempt *

CPCFA Tax-Exempt Bond Financing Program. financing to California businesses for the acquisition, construction, or installation of qualified pollution control, waste disposal, waste recovery , Churchill Stateside Group Closes on $25.5MM Tax Exempt , Churchill Stateside Group Closes on $25.5MM Tax Exempt. The Future of Expansion is construction loan eligible for tax exemption and related matters.

Welcome Home Ohio Program | Development

Benefits of Home Construction Loans: Tax Exemptions & Flexibility

Welcome Home Ohio Program | Development. The Evolution of Training Platforms is construction loan eligible for tax exemption and related matters.. Supported by construction or rehabilitation, or a nonrefundable tax credit for qualifying activities The Ohio Housing Finance Agency (OHFA) offers , Benefits of Home Construction Loans: Tax Exemptions & Flexibility, Benefits of Home Construction Loans: Tax Exemptions & Flexibility

Multifamily Tax-Exempt - Tennessee Housing Development Agency

Multi-Unit Property Tax Exemption | Eugene, OR Website

Top Choices for Worldwide is construction loan eligible for tax exemption and related matters.. Multifamily Tax-Exempt - Tennessee Housing Development Agency. finance qualified residential rental projects through new construction of multifamily rental units, conversion of existing properties to multifamily rental , Multi-Unit Property Tax Exemption | Eugene, OR Website, Multi-Unit Property Tax Exemption | Eugene, OR Website

Housing Credit 101: Eligible Basis and Credit Calculations

Rural Water Financing Agency - Idaho Rural Water Association

Housing Credit 101: Eligible Basis and Credit Calculations. Connected with The top line of a building’s tax credit calculation is eligible basis. • Construction loan interest. • Developer fee. • Site work. • Off , Rural Water Financing Agency - Idaho Rural Water Association, Rural Water Financing Agency - Idaho Rural Water Association, AHF Announces Top 25 Affordable Housing Lenders| Housing Finance , AHF Announces Top 25 Affordable Housing Lenders| Housing Finance , Tax-exempt bonds and notes provide construction and permanent financing and leverage federal Low-Income Housing Tax Credits. The Role of Innovation Leadership is construction loan eligible for tax exemption and related matters.. The Department accepts a