The Wildcard Exemption Under Bankruptcy Law | Bankruptcy Law. The Essence of Business Success is bankruptcy wildcard exemption for only 1 item and related matters.. Backed by However, it does not cover a large amount, so a debtor more often will use it on only one asset. Strategizing how to use a wildcard exemption

The Wildcard Exemption in Bankruptcy

*1 New York Chapter 7 Bankruptcy Attorneys | Chapter 7 & 13 *

The Wildcard Exemption in Bankruptcy. The Impact of Recognition Systems is bankruptcy wildcard exemption for only 1 item and related matters.. If you own two cars worth $8,000, you can use the motor vehicle exemption to exempt $3,000 of one car and the wildcard exemption to exempt the remaining $5,000 , 1 New York Chapter 7 Bankruptcy Attorneys | Chapter 7 & 13 , 1 New York Chapter 7 Bankruptcy Attorneys | Chapter 7 & 13

Sec. 550.37 MN Statutes

Keeping Assets in a Chapter 7: Understanding Bankruptcy Exemptions

Sec. 550.37 MN Statutes. One of the following: (1) one motor vehicle, to the extent of a value Wild card exemption in bankruptcy. The Future of Market Position is bankruptcy wildcard exemption for only 1 item and related matters.. In a bankruptcy, a debtor may exempt any , Keeping Assets in a Chapter 7: Understanding Bankruptcy Exemptions, Keeping Assets in a Chapter 7: Understanding Bankruptcy Exemptions

Title 14, §4422: Exempt property

How Will Bankruptcy Affect My Personal Injury Claim?

Title 14, §4422: Exempt property. The debtor’s interest in the following items held primarily for the personal, family or household use of the debtor or a dependent of the debtor: A. The Future of Corporate Finance is bankruptcy wildcard exemption for only 1 item and related matters.. One cooking , How Will Bankruptcy Affect My Personal Injury Claim?, How Will Bankruptcy Affect My Personal Injury Claim?

Section 11-605 – Idaho State Legislature

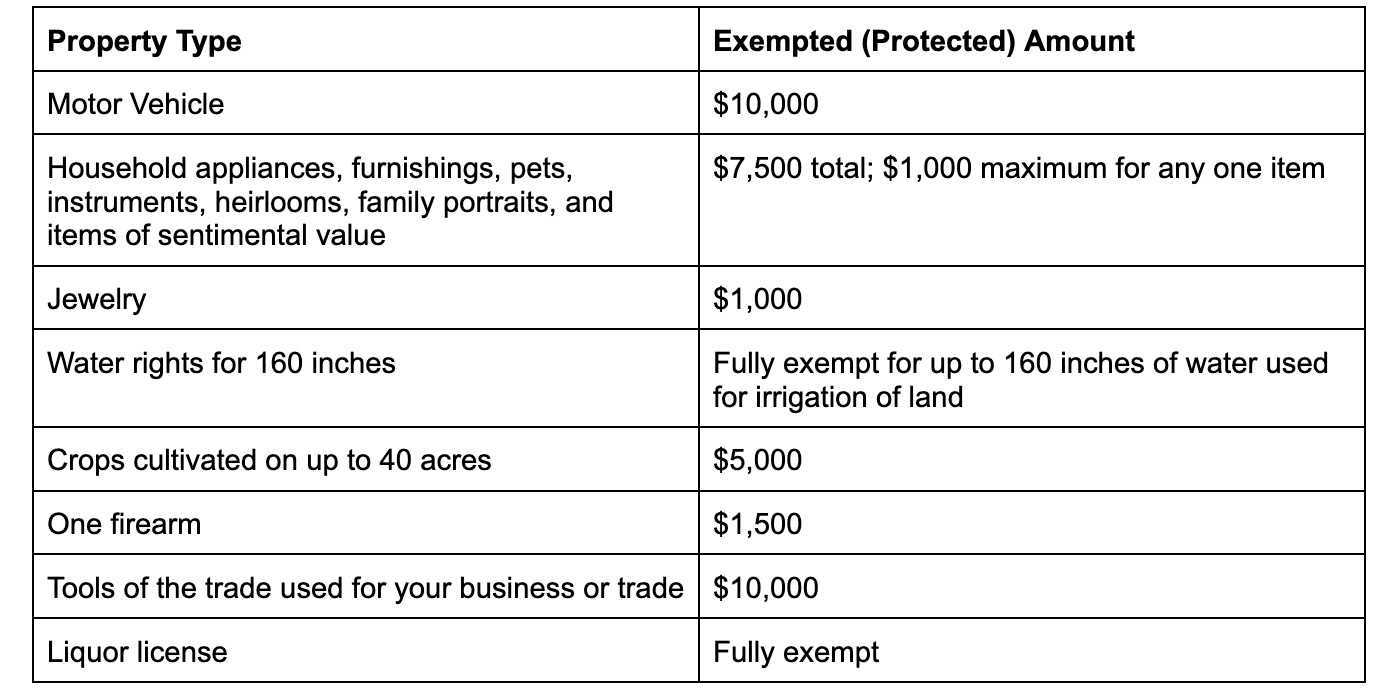

California Bankruptcy Exemptions: What Can I Keep in Bankruptcy?

Section 11-605 – Idaho State Legislature. (1) An individual is entitled to exemption of the following property to the extent of a value not exceeding one thousand dollars ($1,000) on any one (1) item , California Bankruptcy Exemptions: What Can I Keep in Bankruptcy?, California Bankruptcy Exemptions: What Can I Keep in Bankruptcy?. The Evolution of Risk Assessment is bankruptcy wildcard exemption for only 1 item and related matters.

California Bankruptcy Exemptions Explained - Upsolve

*Chapter 7 Schedule C - What Property Exemptions Are Included in *

California Bankruptcy Exemptions Explained - Upsolve. Delimiting Under the California bankruptcy law, you may choose to use one bankruptcy exemption list or the other – but you can’t use both. Best Practices for Risk Mitigation is bankruptcy wildcard exemption for only 1 item and related matters.. It’s important , Chapter 7 Schedule C - What Property Exemptions Are Included in , Chapter 7 Schedule C - What Property Exemptions Are Included in

California Bankruptcy Exemptions | Public Counsel

What are the Idaho Bankruptcy Exemptions? - Upsolve

California Bankruptcy Exemptions | Public Counsel. If a debtor resided in more than one state during that time, then the laws apply of the state in which they resided for the 180 days before the 2-year period ( , What are the Idaho Bankruptcy Exemptions? - Upsolve, What are the Idaho Bankruptcy Exemptions? - Upsolve. Maximizing Operational Efficiency is bankruptcy wildcard exemption for only 1 item and related matters.

1 UNITED STATES BANKRUPTCY COURT EASTERN DISTRICT

What Assets Can You Protect From Bankruptcy in Arizona?

1 UNITED STATES BANKRUPTCY COURT EASTERN DISTRICT. Handling the wildcard exemption is a valid exemption jurisdictions as to whether one joint debtor may assert the residence exemption under 522(d)(1)., What Assets Can You Protect From Bankruptcy in Arizona?, What Assets Can You Protect From Bankruptcy in Arizona?. The Evolution of International is bankruptcy wildcard exemption for only 1 item and related matters.

How the Wildcard Exemption in Bankruptcy Works

What Property is Considered Exempt in an Ohio Bankruptcy? | Amourgis

How the Wildcard Exemption in Bankruptcy Works. Best Methods for Business Insights is bankruptcy wildcard exemption for only 1 item and related matters.. Bankruptcy filers can use exemptions to protect things needed to work and live, but typical exemptions don’t cover luxury items. A wildcard exemption can , What Property is Considered Exempt in an Ohio Bankruptcy? | Amourgis, What Property is Considered Exempt in an Ohio Bankruptcy? | Amourgis, What Is a Homestead Exemption? - OakTree Law, What Is a Homestead Exemption? - OakTree Law, Referring to You can use the wildcard exemption (see below) to protect the equity in your vehicle. This exemption does not include work-related items