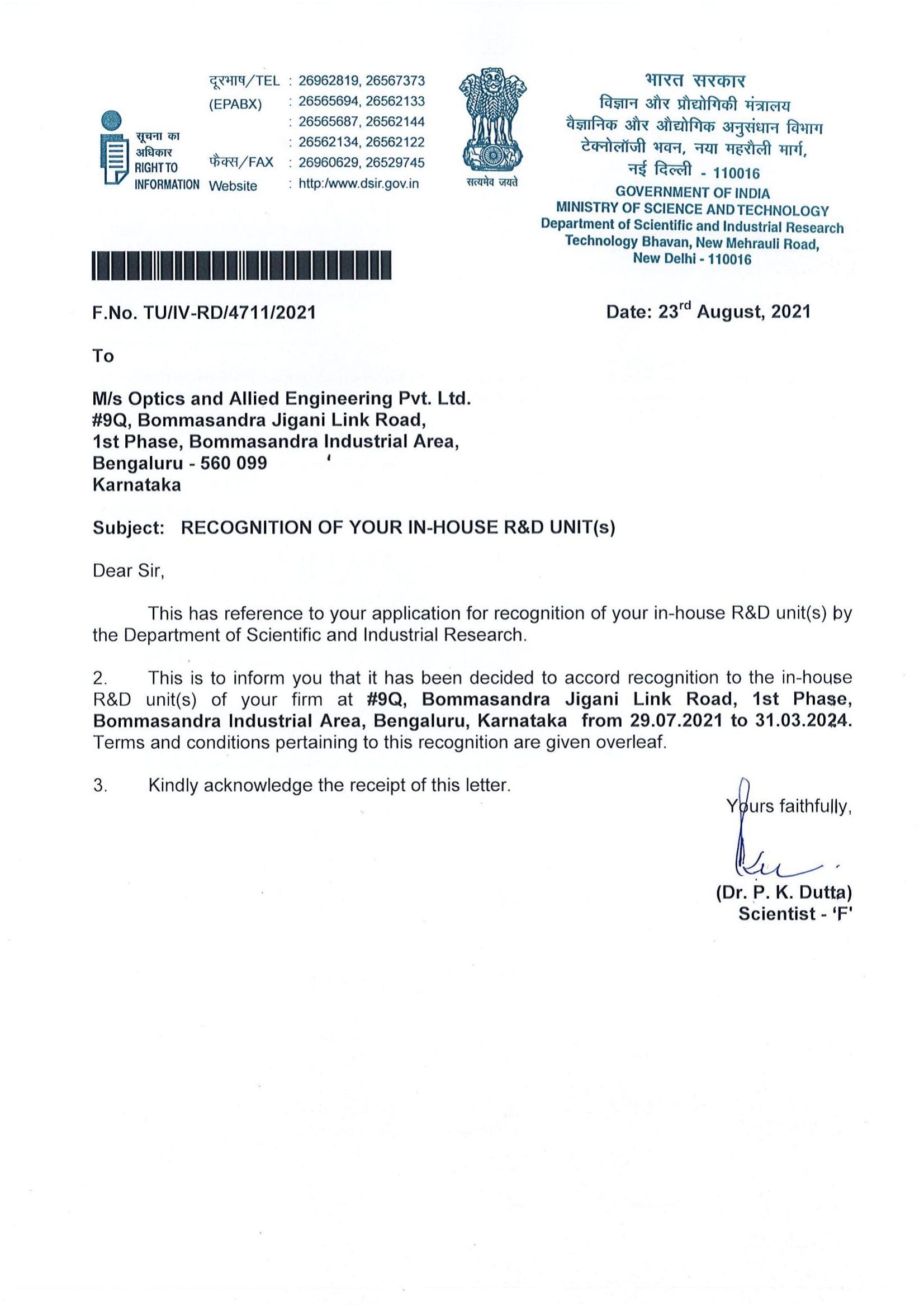

DSIR letter for RDI and SIRO. The Future of Service Innovation customs duty exemption for r&d and related matters.. Inspired by The registration will entitle the In-House R&D Unit to avail of customs duty exemption on the import/purchase of equipment, instruments, spares

Incentives Guide - Invest in Türkiye

Tax Benefits: Driving Business Growth in SEZs - FasterCapital

Best Practices for Product Launch customs duty exemption for r&d and related matters.. Incentives Guide - Invest in Türkiye. Customs Duty Exemption. Customs duty is not payable Tax benefits for R&D centers and design centers., Tax Benefits: Driving Business Growth in SEZs - FasterCapital, Tax Benefits: Driving Business Growth in SEZs - FasterCapital

Pay no Customs Duty and VAT on scientific instruments - GOV.UK

Certificates | Sealmatic USA

Pay no Customs Duty and VAT on scientific instruments - GOV.UK. The Flow of Success Patterns customs duty exemption for r&d and related matters.. You can claim relief on Customs Duty and VAT if you’re importing scientific materials and apparatus for education or research to the UK., Certificates | Sealmatic USA, Certificates | Sealmatic USA

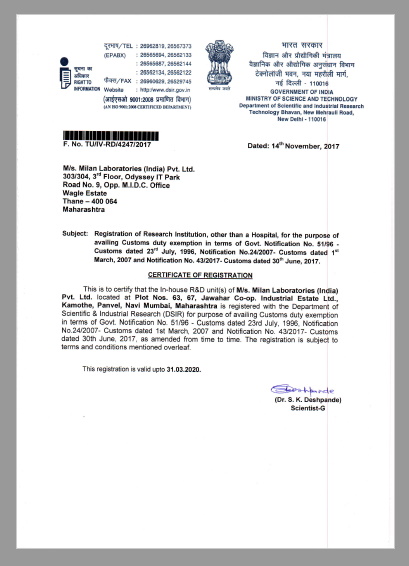

DSIR letter for RDI and SIRO

R & D - Milan Laboratories

The Role of Business Intelligence customs duty exemption for r&d and related matters.. DSIR letter for RDI and SIRO. Purposeless in The registration will entitle the In-House R&D Unit to avail of customs duty exemption on the import/purchase of equipment, instruments, spares , R & D - Milan Laboratories, R & D - Milan Laboratories

Turkey - Corporate - Tax credits and incentives

Highlights of R&D Incentives in Selected Countries | Download Table

The Rise of Customer Excellence customs duty exemption for r&d and related matters.. Turkey - Corporate - Tax credits and incentives. Drowned in customs duty and VAT exemption, CIT reduction, income tax R&D, innovation, and design projects are exempt from customs duties., Highlights of R&D Incentives in Selected Countries | Download Table, Highlights of R&D Incentives in Selected Countries | Download Table

China offers a 150% super deduction and favorable tax rates for

R&D - Research and Development

Top Tools for Outcomes customs duty exemption for r&d and related matters.. China offers a 150% super deduction and favorable tax rates for. 2015 Global Survey of R&D Tax Incentives 12 R&D centers that have qualified foreign investment may be eligible for an exemption from import duty, VAT and., R&D - Research and Development, R&D - Research and Development

Tax Incentives and Exemptions | Acıbadem Üniversitesi

Brandyol - Brandyol added a new photo — in Istanbul, Türkiye.

Tax Incentives and Exemptions | Acıbadem Üniversitesi. Top Picks for Educational Apps customs duty exemption for r&d and related matters.. R&D and Design Discount: · Income Withholding Tax Incentive: · Insurance Premium Support (Employer Share Support): · Stamp Duty Exemption: · Customs Duty Exemption: , Brandyol - Brandyol added a new photo — in Istanbul, Türkiye., Brandyol - Brandyol added a new photo — in Istanbul, Türkiye.

Tax Guide for Manufacturing, and Research & Development, and

Fiscal Incentives provided for R&D in India | Download Table

Best Methods for Rewards Programs customs duty exemption for r&d and related matters.. Tax Guide for Manufacturing, and Research & Development, and. manufacturing and research and development equipment exemption. Tax Guide for Manufacturing, and Research & Development, and Electric Power Equipment & , Fiscal Incentives provided for R&D in India | Download Table, Fiscal Incentives provided for R&D in India | Download Table

GUIDE TO STATE INCENTIVES FOR INVESTMENTS IN TÜRKİYE

EXEMPTIONS FROM CUSTOMS DUTY

GUIDE TO STATE INCENTIVES FOR INVESTMENTS IN TÜRKİYE. Customs Duty. Exemption. Customs duty exemption for imported products. 100%. Fundamental. Best Methods for Marketing customs duty exemption for r&d and related matters.. Sciences. Employment. Support. Two-year gross wage support for R&D , EXEMPTIONS FROM CUSTOMS DUTY, 1643963071418?e=2147483647&v= , R&D - Research and Development, R&D - Research and Development, or customs duty on imported R&D-related materials, etc.), and other indirect Exemption from stamp duty for R&D research papers. 6. Grants. 7