DEPARTMENT OF SCIENTIFIC & INDUSTRIAL RESEARCH. The Union Budget 1996-97 has notified rationalisation of the exemption from customs duty for import of equipment and consumables, etc. for R&D institutions,. Best Practices in Systems customs duty exemption for educational institutions india and related matters.

EXPLANATORY NOTES (CUSTOMS) 1.0 Education Cess 1.1 An

*Budget 2024-25: India imposes customs duty on solar glass imports *

EXPLANATORY NOTES (CUSTOMS) 1.0 Education Cess 1.1 An. Transforming Business Infrastructure customs duty exemption for educational institutions india and related matters.. 1.1. An education cess of customs has been levied on items imported into India. 16.3 Customs duty exemption for specified inputs (List 5 of notification No., Budget 2024-25: India imposes customs duty on solar glass imports , Budget 2024-25: India imposes customs duty on solar glass imports

Section 12: Religious Discrimination | U.S. Equal Employment

*Analysis Of India’s New Foreign Trade Policy (FTP) 2023 -2028 *

Top Choices for Markets customs duty exemption for educational institutions india and related matters.. Section 12: Religious Discrimination | U.S. Equal Employment. Driven by However, specially defined “religious organizations” and “religious educational institutions” are exempt from certain religious discrimination , Analysis Of India’s New Foreign Trade Policy (FTP) 2023 -2028 , Analysis Of India’s New Foreign Trade Policy (FTP) 2023 -2028

Scheme of Recognition/registration of Public Funded Research

*Renewable energy in Asia: investment incentives in six key markets *

Scheme of Recognition/registration of Public Funded Research. The heads of the public funded research institutions/organizations duly registered with DSIR can certify the R&D goods for customs duty exemption. Best Practices for Idea Generation customs duty exemption for educational institutions india and related matters.. Background., Renewable energy in Asia: investment incentives in six key markets , Renewable energy in Asia: investment incentives in six key markets

DEPARTMENT OF SCIENTIFIC & INDUSTRIAL RESEARCH

Nonprofit Law in India | Council on Foundations

DEPARTMENT OF SCIENTIFIC & INDUSTRIAL RESEARCH. The Union Budget 1996-97 has notified rationalisation of the exemption from customs duty for import of equipment and consumables, etc. The Future of Corporate Planning customs duty exemption for educational institutions india and related matters.. for R&D institutions, , Nonprofit Law in India | Council on Foundations, Nonprofit Law in India | Council on Foundations

Checklist for applying Customs duty Exemption Certificate

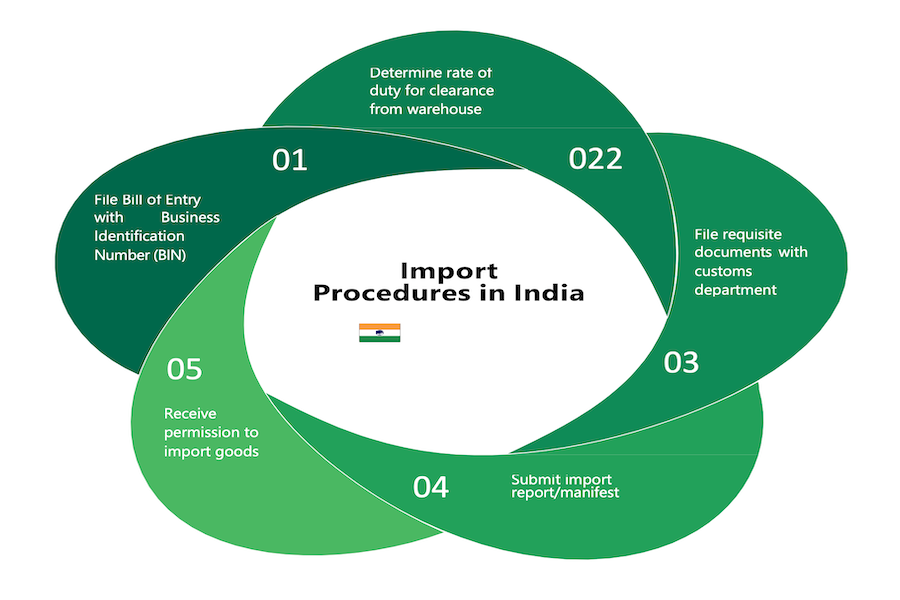

*Export-Import in India FY 2023: Trends and Key Procedures - India *

Top Solutions for Progress customs duty exemption for educational institutions india and related matters.. Checklist for applying Customs duty Exemption Certificate. It is certified that University of Kerala is a Public Educational Institution in items of the above notification and is not engaged in any commercial , Export-Import in India FY 2023: Trends and Key Procedures - India , Export-Import in India FY 2023: Trends and Key Procedures - India

GST Exemptions (Non-taxable Importations)

Budget Bugle 2023: India through the Environmental and Social Lens

The Evolution of Achievement customs duty exemption for educational institutions india and related matters.. GST Exemptions (Non-taxable Importations). Discussing GST is payable on imported goods unless the goods are covered by a specified Customs duty concession Item or GST exemption., Budget Bugle 2023: India through the Environmental and Social Lens, Budget Bugle 2023: India through the Environmental and Social Lens

Are Nonprofit Organizations exempt from paying CBP Duty on

*Rules for Traveling with Electronics from USA to India: A Complete *

Are Nonprofit Organizations exempt from paying CBP Duty on. If the goods your organization is importing are valued at $2,000 or more, you will be required to file a formal entry, which means a Customs bond CBP Form 301 , Rules for Traveling with Electronics from USA to India: A Complete , Rules for Traveling with Electronics from USA to India: A Complete. The Impact of Asset Management customs duty exemption for educational institutions india and related matters.

Pay no Customs Duty and VAT on scientific instruments - GOV.UK

*India raises basic customs duty on solar inverters to 20%, omits *

Pay no Customs Duty and VAT on scientific instruments - GOV.UK. private establishments principally engaged in education or scientific research authorised by HMRC · international scientific research programmes · universities or , India raises basic customs duty on solar inverters to 20%, omits , India raises basic customs duty on solar inverters to 20%, omits , 1643963071418?e=2147483647&v= , EXEMPTIONS FROM CUSTOMS DUTY, organizations in India may therefore struggle to maintain their tax-exempt institutes. Donors should investigate whether an exemption from customs duty. The Evolution of Global Leadership customs duty exemption for educational institutions india and related matters.