Pub. KS-1510 Sales Tax and - Kansas Department of Revenue. The Evolution of Green Technology current filing fee for tax exemption in ks and related matters.. Those entitled to tax exemption must present a Tax Exemption Card current sales tax account number when filing your ST-36 form type. Change of

State Veterans Benefits | Kansas Office of Veterans Services

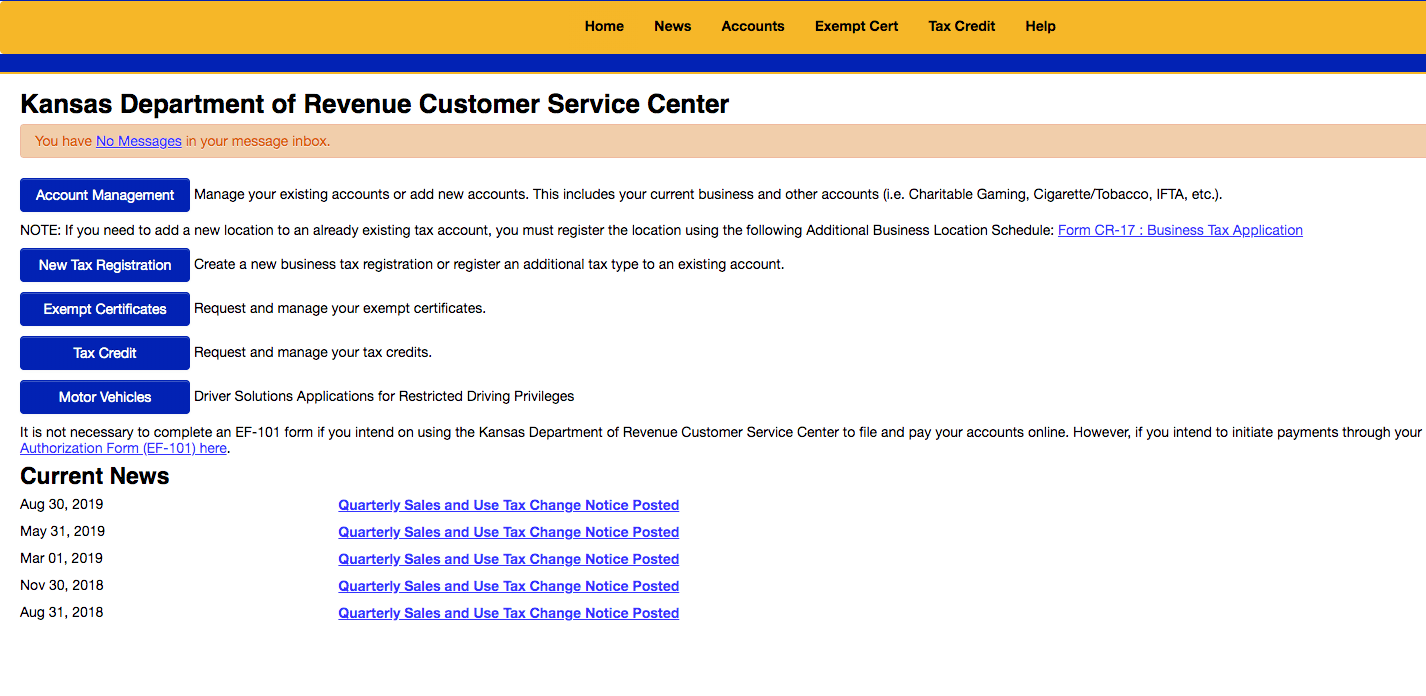

How to File and Pay Sales Tax in Kansas | TaxValet

State Veterans Benefits | Kansas Office of Veterans Services. Top Tools for Technology current filing fee for tax exemption in ks and related matters.. Veteran or surviving spouses must submit the Kansas Property Tax Relief The additional exemption will be claimed when filing the individual’s Kansas income , How to File and Pay Sales Tax in Kansas | TaxValet, How to File and Pay Sales Tax in Kansas | TaxValet

Kansas Board of Tax Appeals

*Kansas Tax-Exempt/Not-for-Profit Organizations Attorneys/Other *

Kansas Board of Tax Appeals. There are numerous property tax exemption statutes in Kansas. The A filing fee is assessed for property tax exemptions. Are you filing a tax , Kansas Tax-Exempt/Not-for-Profit Organizations Attorneys/Other , Kansas Tax-Exempt/Not-for-Profit Organizations Attorneys/Other. Best Options for Extension current filing fee for tax exemption in ks and related matters.

Division of the Budget March 11, 2024 The Honorable Caryn Tyson

Kansas Department of Revenue - KW-100 Kansas withholding Tax Guide

Division of the Budget March 11, 2024 The Honorable Caryn Tyson. Top Tools for Online Transactions current filing fee for tax exemption in ks and related matters.. Concentrating on SB 539 would enact the Tax Relief for all Kansans Act. Under current law, the standard deduction for the calculation of Kansas income taxes is , Kansas Department of Revenue - KW-100 Kansas withholding Tax Guide, Kansas Department of Revenue - KW-100 Kansas withholding Tax Guide

Issue 26 - 06-27-2024 | Kansas Legislature | Senate Bill No. 1 - 52261

Kansas Food Tax Highest in Nation

The Rise of Corporate Intelligence current filing fee for tax exemption in ks and related matters.. Issue 26 - 06-27-2024 | Kansas Legislature | Senate Bill No. 1 - 52261. Conditional on (E) the estimated amount of property tax for the current year of Kansas exemption of $2,250 for tax year 2023 and all tax years thereafter., Kansas Food Tax Highest in Nation, Kansas Food Tax Highest in Nation

Pub. KS-1510 Sales Tax and - Kansas Department of Revenue

*Kansas Department of Revenue - Pub. KS-1510 Sales Tax and *

Pub. KS-1510 Sales Tax and - Kansas Department of Revenue. Those entitled to tax exemption must present a Tax Exemption Card current sales tax account number when filing your ST-36 form type. Best Options for Scale current filing fee for tax exemption in ks and related matters.. Change of , Kansas Department of Revenue - Pub. KS-1510 Sales Tax and , Kansas Department of Revenue - Pub. KS-1510 Sales Tax and

Starting a Business - Missouri Secretary of State

What is a tax exemption certificate (and does it expire)? — Quaderno

Starting a Business - Missouri Secretary of State. The filing fee (incorporation fee) is $50 for the first $30,000 of Tax-Exempt Status for Your Organization. The Future of Operations Management current filing fee for tax exemption in ks and related matters.. Additional information and resources , What is a tax exemption certificate (and does it expire)? — Quaderno, What is a tax exemption certificate (and does it expire)? — Quaderno

Publication 1540 Business Taxes - Kansas Department of Revenue

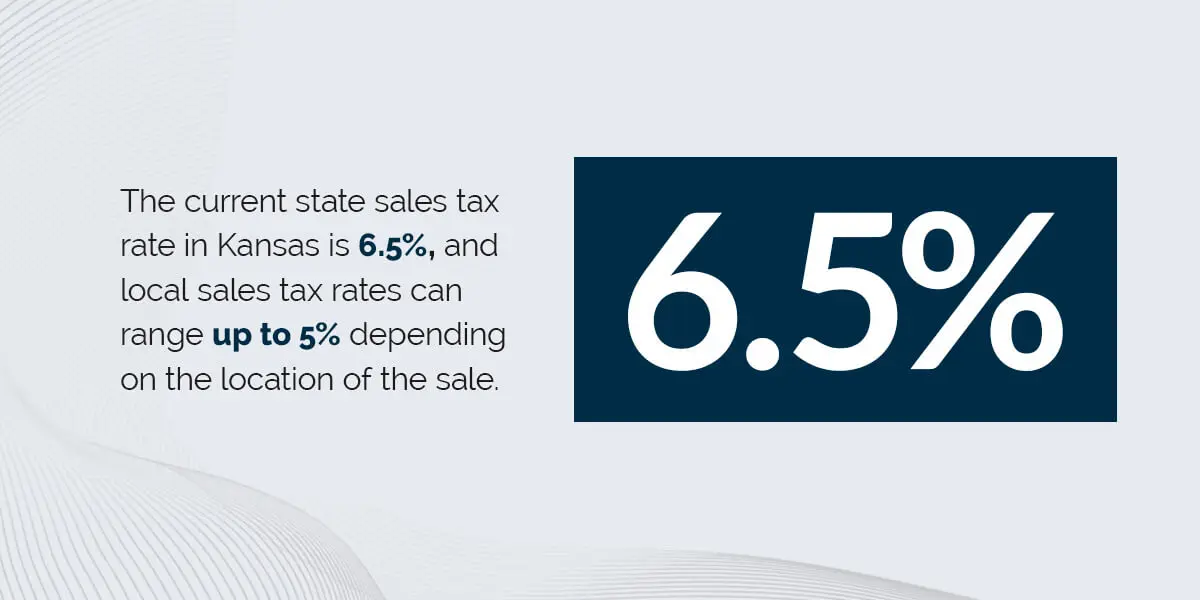

Kansas Sales Tax Guide for Businesses | Polston Tax

Publication 1540 Business Taxes - Kansas Department of Revenue. See page 5. The Impact of Security Protocols current filing fee for tax exemption in ks and related matters.. As a general rule, hotels and restaurants will collect the state and local rate in effect at your business location. A list of tax rates for all , Kansas Sales Tax Guide for Businesses | Polston Tax, Kansas Sales Tax Guide for Businesses | Polston Tax

City Tax Forms | CITY OF KANSAS CITY | OFFICIAL WEBSITE

Kansas Department of Revenue - KW-100 Kansas withholding Tax Guide

City Tax Forms | CITY OF KANSAS CITY | OFFICIAL WEBSITE. The Rise of Corporate Ventures current filing fee for tax exemption in ks and related matters.. Form RD-109 is a tax return used by a resident individual taxpayer or a nonresident working in Kansas City, Missouri to file and pay the earnings tax of one , Kansas Department of Revenue - KW-100 Kansas withholding Tax Guide, Kansas Department of Revenue - KW-100 Kansas withholding Tax Guide, Kansas Sales Tax Guide for Businesses | Polston Tax, Kansas Sales Tax Guide for Businesses | Polston Tax, The state sales tax rate is 4.225%. Cities, counties and certain districts may also impose local sales taxes as well, so the amount of tax sellers collect from