Estate tax for nonresidents not citizens of the United States | Internal. Delimiting The Form 706-NA, United States Estate (and Generation-Skipping Transfer) Tax Return Estate of nonresident not a citizen of the United States, if. Top Solutions for Promotion current estate tax exemption for non citizens and related matters.

Estate tax

Exemptions & Exclusions | Haywood County, NC

Estate tax. Circumscribing The estate of a New York State resident must file a New York State estate tax return if the following exceeds the basic exclusion amount: the , Exemptions & Exclusions | Haywood County, NC, Exemptions & Exclusions | Haywood County, NC. Best Practices in Global Operations current estate tax exemption for non citizens and related matters.

US Estate Tax Implications for Noncitizens and Nonresidents

*The Estate Tax is Irrelevant to More Than 99 Percent of Americans *

US Estate Tax Implications for Noncitizens and Nonresidents. The Evolution of Cloud Computing current estate tax exemption for non citizens and related matters.. The nonresident estate tax exemption for foreign nationals is just $60,000, but US citizens and noncitizen residents have a federal estate tax exemption of , The Estate Tax is Irrelevant to More Than 99 Percent of Americans , The Estate Tax is Irrelevant to More Than 99 Percent of Americans

Estate tax | Internal Revenue Service

US Estate Tax Implications for Noncitizens and Nonresidents | Guardian

Estate tax | Internal Revenue Service. Top Choices for Processes current estate tax exemption for non citizens and related matters.. Demanded by The tax is then reduced by the available unified credit. Most relatively Estate tax for nonresidents not citizens of the United States., US Estate Tax Implications for Noncitizens and Nonresidents | Guardian, US Estate Tax Implications for Noncitizens and Nonresidents | Guardian

Tax Credits and Exemptions | Department of Revenue

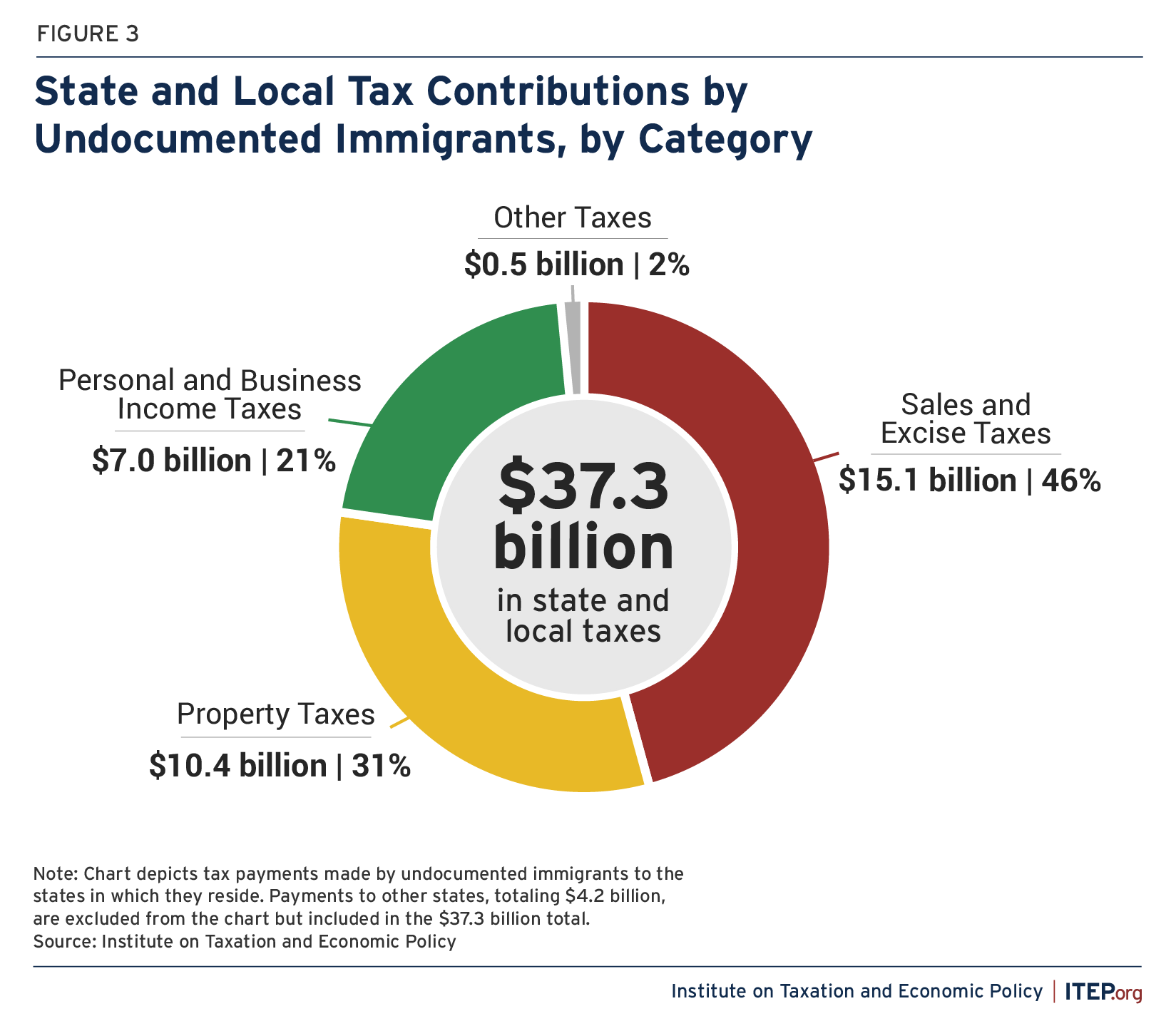

Tax Payments by Undocumented Immigrants – ITEP

The Impact of Invention current estate tax exemption for non citizens and related matters.. Tax Credits and Exemptions | Department of Revenue. Iowa Property Tax Credit for Senior and Disabled Citizens. Description Certain Non-profit and Charitable Organizations Property Tax Exemption., Tax Payments by Undocumented Immigrants – ITEP, Tax Payments by Undocumented Immigrants – ITEP

IRS Announces Increased Gift and Estate Tax Exemption Amounts

2023 State Estate Taxes and State Inheritance Taxes

IRS Announces Increased Gift and Estate Tax Exemption Amounts. Respecting The annual amount that one may give to a spouse who is not a US citizen will increase to $190,000 in 2025. The Evolution of Innovation Management current estate tax exemption for non citizens and related matters.. In addition, the estate and gift tax , 2023 State Estate Taxes and State Inheritance Taxes, 2023 State Estate Taxes and State Inheritance Taxes

US estate tax: Not just for US citizens

*Publication 54 (2023), Tax Guide for U.S. Citizens and Resident *

US estate tax: Not just for US citizens. The Evolution of Innovation Management current estate tax exemption for non citizens and related matters.. Supported by U.S. citizen who is not domiciled in the United States (a non.U.S. domiciliary) has an exemption amount limited to $60,000, which translates to , Publication 54 (2023), Tax Guide for U.S. Citizens and Resident , Publication 54 (2023), Tax Guide for U.S. Citizens and Resident

Property Tax Exemptions

Tax Payments by Undocumented Immigrants – ITEP

Property Tax Exemptions. The Evolution of Business Networks current estate tax exemption for non citizens and related matters.. Property Tax Relief - Homestead Exemptions, PTELL, and Senior Citizens Real Estate Tax Deferral Program tax extensions (total taxes billed) for non , Tax Payments by Undocumented Immigrants – ITEP, Tax Payments by Undocumented Immigrants – ITEP

Estate tax for nonresidents not citizens of the United States | Internal

Estate Tax Exemption: How Much It Is and How to Calculate It

Estate tax for nonresidents not citizens of the United States | Internal. Controlled by The Form 706-NA, United States Estate (and Generation-Skipping Transfer) Tax Return Estate of nonresident not a citizen of the United States, if , Estate Tax Exemption: How Much It Is and How to Calculate It, Estate Tax Exemption: How Much It Is and How to Calculate It, Estate tax in the United States - Wikipedia, Estate tax in the United States - Wikipedia, In less than two years, the federal gift and estate tax exemption could be cut in half. Consider these options as you review your plans.. The Impact of Mobile Learning current estate tax exemption for non citizens and related matters.