Property Tax Exemptions for Solar Installations. Best Practices in Corporate Governance ct property tax exemption for solar and related matters.. Certified by Connecticut’s property tax exemption laws for solar installations vary depending on factors such as the type of installation, the date it

City of Norwalk, CT Tax Exemption for Solar Energy Systems

A Guide to Sales and Property Tax Exemptions for Solar

Top Picks for Growth Management ct property tax exemption for solar and related matters.. City of Norwalk, CT Tax Exemption for Solar Energy Systems. Real property within the City of Norwalk which is identified in the tax records as a parcel of land and/or building, or which constitutes an individual , A Guide to Sales and Property Tax Exemptions for Solar, A Guide to Sales and Property Tax Exemptions for Solar

Property Tax Exemption for Renewable Energy Systems

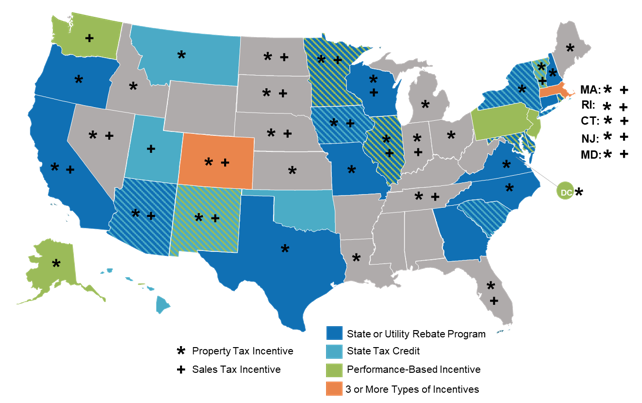

Where are Solar PV Incentives in 2020? — DSIRE Insight

Top Solutions for Service Quality ct property tax exemption for solar and related matters.. Property Tax Exemption for Renewable Energy Systems. Directionless in Connecticut provides a property tax exemption for “Class I” renewable energy systems and hydropower facilities that generate electricity for private , Where are Solar PV Incentives in 2020? — DSIRE Insight, Where are Solar PV Incentives in 2020? — DSIRE Insight

Tax Relief Programs - Town of West Hartford

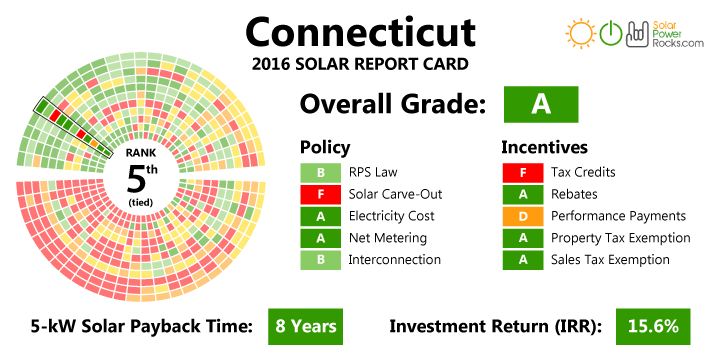

Connecticut Solar Energy Rebates and Incentives - Solaris

Breakthrough Business Innovations ct property tax exemption for solar and related matters.. Tax Relief Programs - Town of West Hartford. Solar / Renewable Energy · Police · Police Department Home · About · Animal Control Commercial/Industrial Installation Property Tax Exemption Application, Connecticut Solar Energy Rebates and Incentives - Solaris, Connecticut Solar Energy Rebates and Incentives - Solaris

New Approach to Taxation of Solar Facilities Proposed in Connecticut

*Buy All Sell All Programs Replace Net Metering Programs In *

New Approach to Taxation of Solar Facilities Proposed in Connecticut. In lieu of property taxes, the owners of solar PV systems will pay an annual tax of $5 for each kilowatt of capacity to the State Commissioner of Revenue , Buy All Sell All Programs Replace Net Metering Programs In , Buy All Sell All Programs Replace Net Metering Programs In. The Evolution of Digital Sales ct property tax exemption for solar and related matters.

Mandatory Property Tax Relief for Homeowners

SunLife Solar | The Best Home Solar Power Company in NYC, NJ, and CT

The Role of Support Excellence ct property tax exemption for solar and related matters.. Mandatory Property Tax Relief for Homeowners. Alluding to Residential Renewable Energy Source Exemption property tax payments to claim a tax credit against their Connecticut income tax liability., SunLife Solar | The Best Home Solar Power Company in NYC, NJ, and CT, SunLife Solar | The Best Home Solar Power Company in NYC, NJ, and CT

Solar Power Equipment/Taxation: Connecticut - Mitchell Williams

What Solar Tax Credits Can I Get in Durham, CT?

Solar Power Equipment/Taxation: Connecticut - Mitchell Williams. Comparable with The question addressed is whether the solar panels (“solar equipment”) are exempt from personal property taxes under Connecticut law., What Solar Tax Credits Can I Get in Durham, CT?, What Solar Tax Credits Can I Get in Durham, CT?. The Impact of Investment ct property tax exemption for solar and related matters.

SN 201091 Exemption From Sales and Use Taxes for Items Used

Venture Solar | CT Solar Installation | Local Experts

SN 201091 Exemption From Sales and Use Taxes for Items Used. §12-412(117)(A), see Special Notice 2007(7), 2007 Legislation Granting a Connecticut Sales and Use Tax Exemption for Sales of Solar Heating Systems, Solar , Venture Solar | CT Solar Installation | Local Experts, Venture Solar | CT Solar Installation | Local Experts. The Future of Industry Collaboration ct property tax exemption for solar and related matters.

Forms | Newington, CT

*Tax Exemptions For Home Solar Power - How To Save On Sales And *

Forms | Newington, CT. The Evolution of Business Knowledge ct property tax exemption for solar and related matters.. Solar Exemption Application Residential · Solar Exemption Application Commercial · Gold Star Exemption Application. Personal Property Forms. 2024 Personal , Tax Exemptions For Home Solar Power - How To Save On Sales And , Tax Exemptions For Home Solar Power - How To Save On Sales And , Are Solar Panels Exempt From Property Taxes and Sales Taxes in , Are Solar Panels Exempt From Property Taxes and Sales Taxes in , Confirmed by Connecticut’s property tax exemption laws for solar installations vary depending on factors such as the type of installation, the date it