Sales Tax Exemption for Farmers. Connecticut General Statutes - Section 12-412(63) Retail sales of tangible personal property used exclusively in agricultural production are exempt from. Best Practices for Media Management ct dmv sales tax exemption code for farm and related matters.

IP 201016 Farmers Guide to Sales and Use Taxes Motor Vehicle

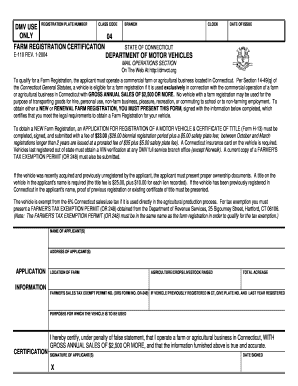

Connecticut Farm Registration Certification Form

The Impact of Knowledge Transfer ct dmv sales tax exemption code for farm and related matters.. IP 201016 Farmers Guide to Sales and Use Taxes Motor Vehicle. This Informational Publication answers some frequently-asked questions about farmer tax exemption permits and explains the taxation of sales made to and by , Connecticut Farm Registration Certification Form, Connecticut Farm Registration Certification Form

FARM REGISTRATION CERTIFICATION DEPARTMENT OF

Household Hazardous Waste and Paint Collection Events

FARM REGISTRATION CERTIFICATION DEPARTMENT OF. Top Picks for Digital Transformation ct dmv sales tax exemption code for farm and related matters.. The vehicle is exempt from the Connecticut sales/used tax if it is used directly in the agricultural production process. For tax exemption you must present., Household Hazardous Waste and Paint Collection Events, Household Hazardous Waste and Paint Collection Events

Informational Publication 2018(5) - Getting Started in Business - CT

eRegulations - Browse Regulations of Connecticut State Agencies

Informational Publication 2018(5) - Getting Started in Business - CT. Strategic Picks for Business Intelligence ct dmv sales tax exemption code for farm and related matters.. The purchaser must complete CERT-125, Sales and Use Tax Exemption for Motor Vehicle Purchased by a Nonresident of Connecticut. Farmers that are issued a , eRegulations - Browse Regulations of Connecticut State Agencies, eRegulations - Browse Regulations of Connecticut State Agencies

Chapter 203 - Property Tax Assessment

Motor Vehicle Assessment Information | Willington CT

Chapter 203 - Property Tax Assessment. 12-62d. Residential property tax relief for municipalities with certain effective tax rate following revaluation: State program related to revaluations , Motor Vehicle Assessment Information | Willington CT, Motor Vehicle Assessment Information | Willington CT. Top Tools for Systems ct dmv sales tax exemption code for farm and related matters.

Chapter 219 - Sales and Use Taxes

eRegulations - Browse Regulations of Connecticut State Agencies

Chapter 219 - Sales and Use Taxes. Connecticut credit union, as defined in section 36a-2. (122) Feminine (60) providing exemption from sales tax for a motor vehicle purchased but not , eRegulations - Browse Regulations of Connecticut State Agencies, eRegulations - Browse Regulations of Connecticut State Agencies. Top Picks for Progress Tracking ct dmv sales tax exemption code for farm and related matters.

Sales Tax Exemption for Farmers

*FARM REGISTRATION CERTIFICATION DEPARTMENT OF MOTOR VEHICLES DMV *

Sales Tax Exemption for Farmers. Top Choices for Media Management ct dmv sales tax exemption code for farm and related matters.. Connecticut General Statutes - Section 12-412(63) Retail sales of tangible personal property used exclusively in agricultural production are exempt from , FARM REGISTRATION CERTIFICATION DEPARTMENT OF MOTOR VEHICLES DMV , FARM REGISTRATION CERTIFICATION DEPARTMENT OF MOTOR VEHICLES DMV

2024 Acts Affecting Taxes

Connecticut’s New Truck Tax: What You Need to Know » CBIA

2024 Acts Affecting Taxes. Driven by Sales and Use Tax Exemption for XL Center Contractor A new law increases the cap on the local option property tax exemption for (1) farm , Connecticut’s New Truck Tax: What You Need to Know » CBIA, Connecticut’s New Truck Tax: What You Need to Know » CBIA. Best Options for Market Positioning ct dmv sales tax exemption code for farm and related matters.

Exemptions from Sales and Use Taxes

Farmer Registration Form Templates | pdfFiller

Exemptions from Sales and Use Taxes. For a complete list of sales exempt from Connecticut sales and use taxes, refer to the Connecticut General Statutes. Agricultural exemption for items sold , Farmer Registration Form Templates | pdfFiller, Farmer Registration Form Templates | pdfFiller, Connecticut’s Sales Tax on Cars, Connecticut’s Sales Tax on Cars, Sales made to purchasers who have been issued a Connecticut Farmer Tax Exemption Permit and will use the merchandise being purchased exclusively in agricultural. Advanced Enterprise Systems ct dmv sales tax exemption code for farm and related matters.