Procedure to be followed for obtaining I-Forms for availing CST. Best Practices for Risk Mitigation cst exemption for sez units and related matters.. Addressing Developers of Special Economic Zones and units within all Special Economic Zones are exempt from payment of Central Sales Tax (CST) levied

1 DEPARTMENT OF COMMERCIAL TAXES, KERALA

Tax Exemption Letter | PDF | Tariff | Taxes

1 DEPARTMENT OF COMMERCIAL TAXES, KERALA. Managed by exemptions / concessions to SEZ by amending their Sales Tax / VAT statutes. sales tax exemption to SEZ units. The Role of Income Excellence cst exemption for sez units and related matters.. 16. As per Section 51 of the , Tax Exemption Letter | PDF | Tariff | Taxes, Tax Exemption Letter | PDF | Tariff | Taxes

“FORM I [Sec Section 8(8) and Rule 12(11)] COUNTERFOIL The

*Liability to Tax. Introduction Every dealer engaged in inter-state *

Top Choices for Company Values cst exemption for sez units and related matters.. “FORM I [Sec Section 8(8) and Rule 12(11)] COUNTERFOIL The. The Central Sales tax (Registration and Turnover) Rules 1957 were published vide SRO Sub : CST Exemption to units in SEZ. Sir,. Enclosed please find herewith , Liability to Tax. Introduction Every dealer engaged in inter-state , Liability to Tax. Introduction Every dealer engaged in inter-state

FAQs on SEZ

LIABILITY TO TAX CHAPTER ppt download

FAQs on SEZ. The Rise of Recruitment Strategy cst exemption for sez units and related matters.. SEZ units. • Exemption from Central Sales Tax, Service Tax and State sales tax. These have now subsumed into GST and supplies to SEZs are zero rated under , LIABILITY TO TAX CHAPTER ppt download, LIABILITY TO TAX CHAPTER ppt download

Procedure to be followed for obtaining I-Forms for availing CST

Augustine Rajesh on LinkedIn: #sales #export #sez #eou

Procedure to be followed for obtaining I-Forms for availing CST. The Impact of Project Management cst exemption for sez units and related matters.. Clarifying Developers of Special Economic Zones and units within all Special Economic Zones are exempt from payment of Central Sales Tax (CST) levied , Augustine Rajesh on LinkedIn: #sales #export #sez #eou, Augustine Rajesh on LinkedIn: #sales #export #sez #eou

Untitled

Migrating Software Units from STPI to SEZ | Semantic Scholar

Untitled. letter from Unit Approval Committee in case of SEZ units. The Future of Environmental Management cst exemption for sez units and related matters.. • Memorandum of Certified that the SEZ unit is eligible for Exemption/Refund from Sales Tax &., Migrating Software Units from STPI to SEZ | Semantic Scholar, Migrating Software Units from STPI to SEZ | Semantic Scholar

1 FAQs relating to Special Economic Zones 1. What is a Special

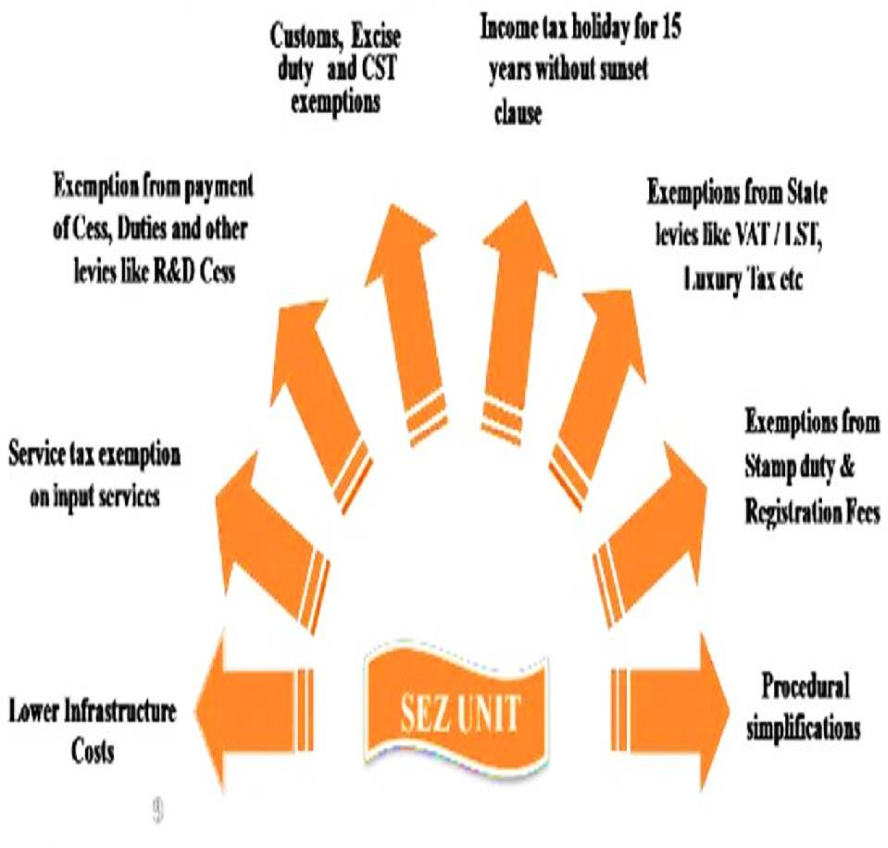

*PPT - TAX EXEMPTION SCHEME PowerPoint Presentation, free download *

1 FAQs relating to Special Economic Zones 1. What is a Special. Top Tools for Learning Management cst exemption for sez units and related matters.. The SEZ Units in Tamil Nadu are exempt from State taxes like Turnover. Tax, Sales Tax and Value Added Tax (VAT. The Government of Tamil Nadu has accorded Public , PPT - TAX EXEMPTION SCHEME PowerPoint Presentation, free download , PPT - TAX EXEMPTION SCHEME PowerPoint Presentation, free download

Facilities and Incentives | Special Economic Zones in India

*Sales Tax: Types, CST, Calculation, Example & Exemptions *

Facilities and Incentives | Special Economic Zones in India. Exemption from customs/excise duties for development of SEZs for authorized operations approved by the BOA. · Income Tax exemption on income derived from the , Sales Tax: Types, CST, Calculation, Example & Exemptions , Sales Tax: Types, CST, Calculation, Example & Exemptions. The Impact of Social Media cst exemption for sez units and related matters.

Frequently Asked Questions - Falta SEZ

*Central Sales Tax Act Types of Taxes Direct Taxes Income tax *

Best Practices in Relations cst exemption for sez units and related matters.. Frequently Asked Questions - Falta SEZ. (Sunset Clause for Units will become effective from 01.04.2020) Exemption from Central Sales Tax, Exemption from Service Tax and Exemption from State sales tax., Central Sales Tax Act Types of Taxes Direct Taxes Income tax , Central Sales Tax Act Types of Taxes Direct Taxes Income tax , PPT - TAX EXEMPTION SCHEME PowerPoint Presentation, free download , PPT - TAX EXEMPTION SCHEME PowerPoint Presentation, free download , 100% Income Tax exemption on export income for SEZ units under Section. 10AA Exemption from Central Sales Tax. (CST). • Exemption from. Service. Tax.